Is Streaming a Good Business?

For most of the media companies, 20% margins are out of reach— and it’s not just about content costs

[Note that this essay was originally published on Medium]

In the wake of the recent slowdown in streaming subscriber additions, media investors have turned their focus from streaming subscriber growth to streaming business profitability.

About two years ago, I posted an essay called One Clear Casualty of the Streaming Wars: Profit. In a nutshell, it argued that the profit pool for streaming TV will be structurally smaller than the profit pool for traditional pay TV networks due to pressure on both the top and bottom lines: consumers will spend less when empowered to create their own virtual bundles and a large proportion of viewing will be ad-free; at the same time, margins will be lower due to deep-pocketed entrants with different profit motives, high operating costs to run a D2C business and lower consumer switching costs (and therefore higher churn). And, as a result, the shift of consumer time and attention from traditional linear networks to streaming is a net negative for the big media companies.

At the time, the profitability of streaming didn’t matter much. Mirroring sentiment in the broader market, what mattered was growth. NFLX was trading at over $500 — over 40x forward consensus EBITDA estimates — and the Street was encouraging the media conglomerates to chase Netflix’s sub count and multiple regardless of the collateral damage to their legacy businesses. Plus, industry-wide, streaming subs were growing rapidly. Being on the vertical part of the S-curve tends to render everything else moot. Whether streaming is a good business wasn’t an important question then. But now it has taken center stage.

So, is streaming a good business?

In this essay, I revisit the question, first by defining what a “good business” means in this context and then digging into Netflix’s unit economics to try to answer it.

Tl;dr:

If a “good business” is defined as at least~20% margins, then streaming isn’t a good business for most of the media companies.

Contrary to perception, content costs are only part of the reason.

Now that Netflix has stopped growing in North America, it’s easier to figure out its unit economics. They provide an important reference point for the potential profitability of the media companies’ streaming businesses.

Netflix spends an estimated $10-11 per subscriber monthly in North America on content, marketing and other operating costs, comprising ~$5-6 in (book amortization of) content, $1 on maintenance marketing and ~$4 on other opex.

Whether Netflix’s content spend is a good benchmark for the media companies is an open question: it has a far larger sub base over which to amortize spend, but it also lacks large libraries of mostly-amortized content. Let’s call it a wash and put the question aside.

Although it gets much less attention, churn is costly. Most of the media companies reportedly have churn rates that are double or triple Netflix’s. Even if their marketing is as efficient as Netflix’s (which it probably isn’t), that means their maintenance marketing costs — i.e., the monthly amortization of SAC over the life of their subs — is at least double or triple too.

It is also hard to see how the media companies can possibly manage their other operating costs better than Netflix can. Running a direct-to-consumer business simply requires activities that operating linear networks do not.

Adding it up, the media companies likely will incur marketing and other operating costs of $6–8 per subscriber monthly —before dollar one of content spend. For many of them, that is close or equivalent to ARPU.

This analysis shows that even if there is a tacit collective agreement to rationalize content spending, other costs will stay stubbornly high. And, if lower content spend increases churn, maintenance marketing costs may actually increase. To a degree, cutting production spend may be pushing on a string.

After making massive bets on streaming, the key question for the media companies is: what now?

What is a “Good Business?” Let’s Go With At Least 20% OI Margins

Before determining whether streaming is a good business, we need to define what that means in this context. As mentioned, the premise of my prior essay was that the profit pool of streaming will be smaller both because there will be less revenue and margins will be lower. In this essay, I focus solely on the latter. What level of margins would qualify as a “good business?”

Since streaming is slowly replacing linear TV, “good margins” would need to be roughly equivalent to, or better than, traditional TV networks margins.

Traditional TV Margins as a Reference Point

Figure 1 shows operating income (OI or EBIT) margins for the TV networks operations of the largest media companies in the U.S. in 2019. (I chose 2019 because for most of the conglomerates it precedes a big push into streaming, which lowered margins, and therefore gives a sense of the baseline level of profitability.) All of these reflect a mix of domestic and international pay TV networks and, in some cases (Disney, Paramount, NBCU and Fox) also include domestic broadcast operations, both local stations and a national broadcast network. Domestic pay TV networks have the highest margins (usually mid 30s-low 40s), dragged down by lower international and broadcast margins. But the point is simple: TV is a very good business, with margins that generally (and sometimes substantially) exceed 20%.

Figure 1. TV Network Margins Range from ~20–40%, Depending on Business Mix

Source: Company reports. Note: Disney is on a September fiscal year and Fox is on a June fiscal year.

All the Conglomerates’ Streaming Businesses are Running Losses for Now…

For right now, the media conglomerates are all in ramp up mode and turning any profit in streaming is still aspirational. But only Disney and Paramount have chosen to break out the detailed financial results of their streaming operations. As shown in Figure 2, in 2021, Disney generated an OI margin of (10%) and Paramount (31%). By contrast, Netflix is currently running a 21% margin on a global basis.

Figure 2. Disney and Paramount Have Broken Out Streaming Profits

Source: Company reports. Note: Disney is on a September fiscal year.

…But the Consensus Margin Target is Forming Around 20%

Also not surprisingly, given their early stage, the media companies have provided only rough guidance for expected profitability of their streaming businesses. As shown below, Disney has provided timing for reaching profitability but no magnitude; both Discovery and Paramount have given margin guidance that could be interpreted as “around 20%,” but with no indication of timing.

Figure 3. Streaming Profit Guidance from the Media Companies is Limited

Source: Company reports.

So, we have an answer: although it’s a low bar relative to the profitability of the traditional TV business, let’s use “at least 20% OI margins at scale.”

Are 20% Margins Achievable? For Most, Probably Not

Low bar or not, for most of the media conglomerates it will be difficult to achieve 20% margins. Importantly, it’s not only about content spend. The best way to show that is by examining Netflix’s unit economics.

Netflix’s Unit Economics are Daunting

As a generality, it’s hard to take the income statement of a growing company and confidently infer its unit economics, simply because you don’t know what costs are attributable to the existing customer base and what are investments to support growth. Now that Netflix’s growth has slowed, it is much easier to determine its costs per subscriber (especially in North America, where growth has stopped).

Now that Netflix’s growth has slowed, it is possible to reliably determine its unit economics

With 220 million subscribers globally and 73 million in North America, Netflix has obviously achieved a level of scale that is beyond the aspirations of any of the media conglomerates, other than Disney. Yet it’s per-subscriber costs remain stubbornly high. As shown in Figure 4, for the last several years it has continued to spend about $9 per subscriber monthly, on a global basis. (This reflects book expenses, not cash expenses.) Netflix doesn’t break out costs by region anymore, but assuming that UCAN generates higher margins than the company overall (I assume 25%, 26% and 27% in 2019, ’20, and ’21, respectively), this implies $10-11 in cost per subscriber monthly in North America last year.

Figure 4. Netflix Spends About $9 Per Sub Globally and an Estimated $11 in North America

Source: Company reports, Author estimates. Note: Reflects content amortization, not cash costs.

This is a daunting benchmark for the media companies’ streaming efforts. Figure 5 shows the most recent ARPU for the major streaming services. Clearly, other than Netflix North America (or, to use their terminology, UCAN) and maybe Hulu, none of these services can generate a 20% margin with $10-11 in monthly costs per subscriber.

Figure 5. Most Recent ARPUs

Source: Company reports, Author estimates. Note: All as reported as of most recently-reported quarter, with the following exceptions: HBO Max from 1Q22 AT&T earnings report; Peacock based on commentary in Comcast 4Q21 earnings that service had 24.5MM monthly active accounts (MAA) and 9MM paying subs, with ARPU for paying subs “approaching $10” — as of 2Q22, it had 27MM MAA and 13MM paying subs; Discovery+ based on guidance last provided December 2020, assuming mix of 50/50 ad-free and ad-lite plans.

It’s Not Just About Content, It’s About Opex and Churn Too

This is an admittedly simplistic analysis and begs the question whether Netflix’s cost structure is an appropriate bogey for the media companies’ streaming businesses. So, let’s stake a deeper look by decomposing Netflix’s costs into the most logical components: content, marketing and other operating costs (although we won’t tackle them in that order). Even though most of the discussion about costs revolves around content spend, these latter two categories are critically important.

Figure 6. Decomposition of Netflix Unit Costs, Globally and North America

Source: Company reports, Author estimates. Note: “Programming” reflects content amortization, not cash costs.

Content. As shown in Figure 6, globally Netflix spent about $5 per month, per subscriber, on programming in 2021 and I estimate it spent ~$5-6 in North America. (Note that here “programming” is defined as content amortization, not cash spend, which is substantially higher. So, for those who believe that Netflix’s annual content amortization understates its true costs, it’s a conservative approach.)

Whether this is a fair comparison for the media companies’ streaming businesses is an open question. Let’s be wishy-washy about it. On the one hand, Netflix has an enormous number of subscribers globally over whom to amortize its content spend — and since subscribers care about the quantity and volume of content on a streaming service, not the “spend per subscriber” — this argues that Netflix’s competitors need to spend more per subscriber to remain competitive. On the other, the media companies also have vast libraries of content that have been largely or completely amortized that can provide bulk to their streaming offerings at relatively low cost and, in some cases, rich franchises with rabid fan bases that Netflix lacks — meaning they may be able to attract subscribers with a lower volume of new content. For a medium-large sized media company streaming service, let’s call the disadvantage in subscriber scale and the advantage in having existing library a wash. As support, I estimate that last year Disney spent about the same in programming per subscriber at Disney+ (ex. Hotstar) as Netflix, around $5–6 (Figure 7). It’s a somewhat lazy approach, but that’s because the next two spending categories receive less attention and are therefore more interesting.

Figure 7. Last Year, Disney Also Spent About $5 on Content Monthly Per Disney+ Sub

Source: Company reports, Author estimates. Note: Reflects estimate of Disney+ programming allocated to Hotstar.

Non-programming, non-marketing spend. It costs a lot to run a direct-to-consumer service. As shown in Figure 8, last year, Netflix spent over $5 billion in non-programming costs of revenues. That comprises acquisition, licensing and production personnel; music licensing; content delivery costs; and “other operations” costs. It also spent over $2 billion on technology. Collectively, these costs, plus G&A, come out to >$3 per subscriber per month globally and probably more in North America.

It will likely be very hard for traditional media companies to manage their operating cost structures better than Netflix. Over the last several years, many media companies have integrated or partially integrated their broadcast operations and streaming video workflows, creating some synergies in running traditional linear and streaming services. Nevertheless, running a direct-to-consumer product involves a lot of components that weren’t necessary to run linear channels (some of which the media companies have built and some of which they outsource): content management systems, metadata management, content delivery (through a CDN), digital rights management, recommendation systems, subscriber management systems, customer service and support, session monitoring and management, account management, billing, payment systems, and, of course, the UI itself, which requires continuous refinement and A/B testing. (Also, note that Netflix’s historical operating costs do not yet reflect any expense to run advertising operations, which all of the media companies are now incurring. This is a non-trivial expense even for media companies that can leverage existing advertising infrastructure.) And the fact that Netflix’s non-programming costs of revenues and technology costs have actually increased on a per-subscriber basis over the last few years (Figure 8) suggests there aren’t any economies of scale in these expenses.

Figure 8. Detailed Breakdown of Netflix Monthly Costs per Sub, Global

Source: Company reports.

Figure 9. Estimated Detailed Breakdown of Netflix Monthly Costs per Sub, North America

Source: Company reports, Author estimates.

Marketing. As alluded to above, since Netflix has stopped growing in North America, all its marketing spend is effectively maintenance marketing. As shown in Figure 9, I estimate that Netflix’s maintenance marketing costs in North America are about $1 per subscriber per month. But this is far below the costs that are likely incurred by the media companies because they have much higher churn.

None of the streaming companies, include native streamers like Netflix and the streaming operations of the media conglomerates, report churn. However, customer analytics provider Antenna computes churn data in the U.S. by analyzing third party data sets, including credit card data. Anecdotally, I’ve heard that many of the streaming providers are Antenna customers, which I’ll treat as a tacit endorsement of the validity of the data.

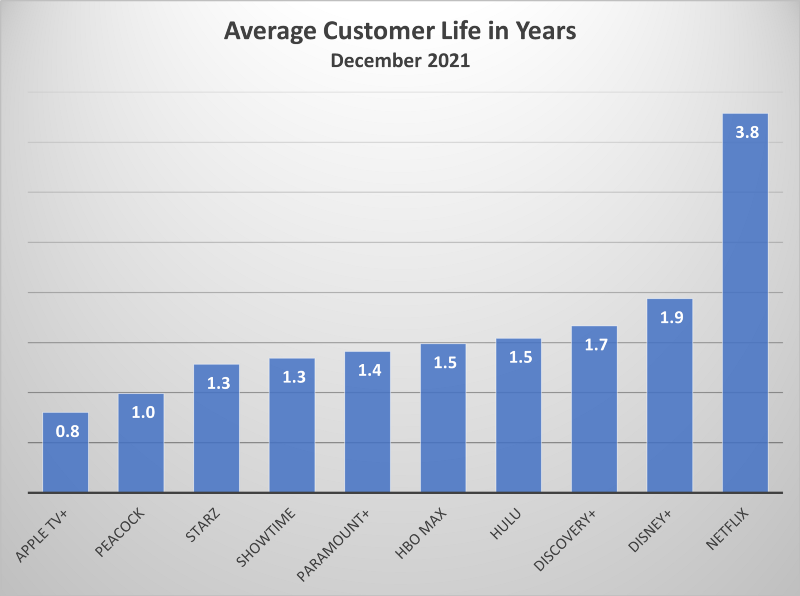

Figure 10. There is a Wide Disparity in Premium SVOD Churn Rates, Corresponding to a Wide Disparity in Average Customer Life

Source: Antenna, Author estimates. Note: These are U.S. only.

Figure 10 shows domestic churn for December 2021 for the primary SVOD services, which ranges from 2.2% for Netflix to over 10% for Apple TV+. It also shows translation of churn into average customer life: 1 ÷ monthly churn = average life in months. Netflix’s churn equates to an average customer life of 3.8 years and Apple’s equates to 10 months.

Figure 11. Netflix SAC was About $50 in North America in 2021

Source: Company reports, Author estimates.

The effect of churn on costs is not well understood. Every subscription business incurs a cost to acquire subscribers, the appropriately-named subscriber acquisition cost (SAC). Another way of thinking about maintenance marketing is that it’s equivalent to the amortization of the SAC over the life of the customer, plus any ongoing retention marketing. If you spent $100 to acquire a subscriber and she sticks around for 10 months, you effectively spent $10 monthly in marketing. If you spend 3% of revenue on retention marketing, that is also an ongoing cost.

For our purposes we don’t care how much of maintenance marketing is SAC and how much is retention — every retained subscriber is one that doesn’t need to be replaced; every added subscriber is one that doesn’t need to be retained. So, for simplicity sake let’s assume it’s all SAC. For Netflix, this includes brand advertising, tune-in advertising (i.e., advertising for specific movies or shows), performance marketing and bounties it pays distribution partners, like connected device manufacturers.

How much is Netflix’s SAC? We have an estimate of marketing spend in North America, now we need gross additions. Those can be computed using net additions, the size of the subscriber base and churn. In 2021, Netflix added a net 1.3 million subscribers in North America. However, if we use the Antenna estimate of 2.2% monthly churn, it actually had almost 20 million disconnects in 2021, which means it needed 21 million gross additions to net this 1 million new subs. As shown in Figure 11, based on 21 million gross additions, Netflix spent about $50 per gross addition in 2021. With an estimated average customer life of 45 months (or 3.8 years), that yields a monthly amortization, or maintenance marketing, of about $1 per subscriber.

Now we can apply this same logic to Netflix’s competitors. The challenge for all of them is that they have higher churn and therefore they are amortizing acquisition costs over a shorter period. Their SAC is also probably higher. Given that Netflix has been marketing its streaming service for over a decade and has extraordinary brand equity and unaided recall; longstanding relationships with distribution partners; and a high number of returning subscribers, it’s probably safe to say that the media companies are incurring higher SAC than Netflix. But let’s suppose that they are spending a comparable amount. As shown in Figure 12, at estimated churn rates of 5–6% for most of the media companies’ streaming services, they are likely incurring at least $3 in monthly amortization of subscriber acquisition costs.

Figure 12. At Comparable SAC to Netflix, Most Media Companies are Incurring $3+ Monthly Per Sub in SAC Amortization

Source: Antenna, Author estimates.

Adding it Up: It’s Tough Regardless of Content Spend

Adding this all up, you get ~$5–6 for programming, ~$3–4 for marketing and another ~$3–4 for other opex, or $11–14 per subscriber in monthly costs.

To repeat a critical point, it’s not all about content spend. Recently, there have been signs that the industry will pull back on programming spending. Most notably, in its 2Q22 earnings call, Netflix management said that $17 billion in cash content spend was in the “right zip code” for the next few years, the first time it has signaled content spending will flatten out. However, even if the industry tacitly agrees to spend less on content, the other two expenses will be much harder to control. Opex kind of “is what it is,” and marketing spend will be a function of customer churn. For the media companies, marketing and other opex alone may run $6–8 monthly even before dollar one of content spend. For many of them, that is close to or equal to ARPU (Figure 5).

For the media companies, marketing and other opex may run $6–8 monthly before dollar one of content spend.

Could reducing content spend help? Only maybe. Given the extremely low consumer switching costs and consumers’ expectations of a steady diet of new content, there is a risk that reducing content spend is pushing on a string and doing so will just increase churn. If so, reductions in content spending may be partially or fully offset by higher maintenance marketing costs.

What Now?

Stepping back, here’s a way of thinking about what’s happened in the TV networks business over the last few years, framed in the cost categories I used above, content, operating expenses and marketing:

Content: Netflix built up a content cost structure predicated on a TAM that now seems unachievable.

Opex: Fearful of Netflix’s growing market power and envious of its valuation, the media companies all pursued it’s business model and, in the process, each replicated distribution infrastructure that formerly was handled by its distributors.

Marketing: Consumers became accustomed to the ease of churning on and off — structurally increasing marketing costs — as well as a constant supply of new, high-production quality content.

As a result, for most of the media companies, on current course streaming is not a good business. The good news is that content spending is controllable. The bad news is that the latter two are likely not.

If you’re a big media company, what do you do? There aren’t any easy answers. More on that next time.