Video’s Fundamental Problem: It Over-Monetizes

Streaming Won’t Fill the Pay TV “Hole.” Let’s Move On.

[Note that this essay was originally published on Medium]

The TV business is going through a difficult transition, even putting aside near-term challenges like the writers’ strike and the effect of macroeconomic uncertainty on ad spending. Over the past year or so, the consensus expectations for both linear TV and streaming have gotten worse. Linear pay TV revenue is (finally) starting to decline (as affiliate fee price increases are no longer enough to offset the accelerating pace of pay TV subscriber losses) and streaming, while growing, isn’t growing as fast as many hoped or expected. I’ve explored those dynamics in several pieces over the last few years, including One Clear Casualty of the Streaming Wars: Profit, Is Streaming a Good Business?, Media’s Shift from Growth to Optimization and To Everything, Churn, Churn, Churn.

In the midst of this somewhat bleak backdrop, there is apparently still a question in the market whether streaming will ever make up for lost pay TV profits.

A few months ago, AMC Networks Executive Chairman James Dolan made headlines when he wrote in an internal memo that:

It was our belief that cord-cutting losses would be offset by gains in streaming. This has not been the case.

Tom Rogers, a longtime media executive, recently encapsulated the industry’s challenge on CNBC:

…where all the media companies need to be pressed is: Is the growth of streaming as it moves toward profitability ever going to make up for the decline in the traditional television business? No one has really demonstrated yet how they believe the hole left by the decline of legacy media is going to be made up by streaming. And until that happens, it’s really hard to get too excited about anything on the streaming side, because that’s the essential question.

The short answer to this essential question: streaming won’t offset linear declines. Failure to acknowledge that is hurting the industry. It’s time to move on.

Tl;dr:

There is still a question in the market whether streaming TV profits will ever replace the declining profits of traditional pay TV.

This is partially due to the generally optimistic narrative from the big media companies and some recent positive developments in streaming, such as price increases, new ad tiers, sequential improvement in operating losses and moderation in content spend.

But there is a very basic question that cuts through the noise: as the transition to streaming from linear continues, will there be more revenue or less?

The answer is less, because historically video over-monetizes.

This can be illustrated in two ways: 1) traditional TV monetizes at about twice the rate of streaming TV per hour of consumption; and 2) video overall monetizes about 50% higher than gaming and 3X audio per hour of consumption. The transition from linear to streaming is effectively wringing out this excess monetization.

Whether streaming profits will replace linear profits is no longer relevant. Even this high-level analysis shows why they won’t. The media companies need to optimize the value of their existing portfolios of assets — linear networks, streaming services, film and TV production studios, libraries — and create new businesses that leverage their IP, brands, audiences and capabilities.

Nostalgia for a declining business model only impedes that process.

Will There be More Revenue or Less?

Nearly three years ago, I posted a piece called One Clear Casualty of the Streaming Wars: Profit, which argued that, in the U.S.,¹ the profit pool of streaming is structurally smaller than traditional pay TV. The rationale I laid out at the time was that, relative to traditional pay TV, streaming profits would be squeezed from both the top and the bottom:

Revenue per household is likely to be lower in streaming because the unbundling of the pay TV bundle will enable consumers to better align consumption and expenditure and spend less.

Costs are likely to be higher both because of an arms race to put ever higher quantity and quality of programming on screen and the high operating costs of running a D2C business, exacerbated by very high churn.

Since I wrote that piece, that facts have mostly borne out that rationale — and in some cases even more so than I expected. The streaming market is topping out in the U.S. as the number of streaming services per home approaches 4 (Figure 1). There has also been more evidence that the cost structure of running the business is higher than expected (something I wrote about in Is Streaming a Good Business?). And churn has proven a much bigger problem than most anticipated. (For more on why churn was the industry’s biggest surprise and remains one of its biggest challenges, see To Everything, Churn, Churn, Churn.)

Figure 1. Streaming Services Per Home is Topping Out

Source: US Census, OECD, Parks Associates, Ampere, Author analysis.

Nevertheless, the question apparently persists whether streaming will replace traditional TV profits, in part because there are a lot of conflicting signals.

Like most public companies, the big media companies tend to express optimism about their businesses. None of them has conceded publicly that streaming won’t make up for lost pay TV profits. Plus, in the last year, they have taken encouraging steps to boost profitability, such as price increases, launches of new ad tiers and cost cuts. It’s fair to ask whether that will turn the tide. What if recent pushes into addressable advertising on SVOD meaningfully lift revenue? What if there is even greater moderation in content spend, as we have started to see from Netflix, Disney and Warner Bros. Discovery? Or, the biggie, what if there is a rationalization of the industry structure that results in fewer independent streaming services, which should both increase pricing power and reduce churn (something I wrote about in What Will Streaming Peace Look Like?). All of these would be positive and all of them are either happening or seem more likely by the day.

A basic question cuts through the noise: As the transition to streaming continues, will there be more revenue or less?

There is a basic, high-level question that helps cut through the noise: as the transition to streaming continues, will there be more revenue or less? The answer is less, for a simple reason. Historically, video over-monetizes.

Monetization Matters Because Consumption Isn’t Really Growing

By “monetization,” I mean the revenue generated per unit of consumption. The revenue of any business is a function of price X units sold. In the case of media, there are several business models — subscriptions, transactions, advertising, sponsorships, etc. Monetization is meant to encompass all of these.

The reason that monetization is the single most important metric in film and TV is because, in the U.S., long form video consumption is not going up. (This includes traditional linear video and streaming of professionally produced content, but excludes short form like YouTube and TikTok).

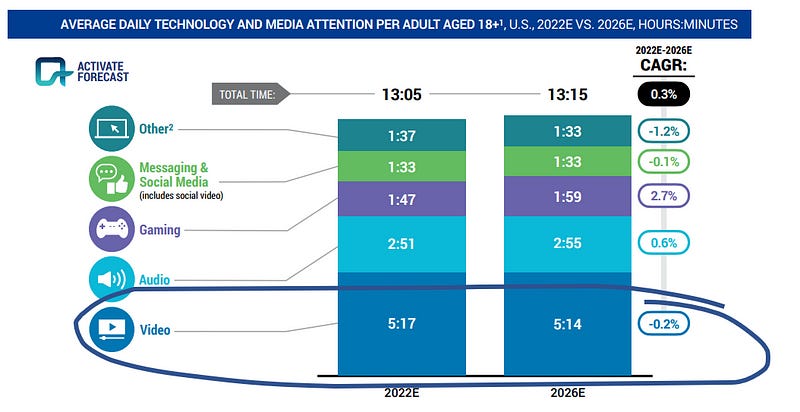

The best way to show this is to use time spent data compiled by Activate, which it has been tracking for years (Figure 2). As shown, in the U.S., last year the average adult spent over 5 hours per day watching long form video. Other than a bump from COVID in 2020–2021, this has been stalled out for a long time (Figure 3).

There is little reason to think this will grow much from here. There are only so many hours in the day and a lot of other media compete for consumers’ attention. Activate forecasts that it will decline between 2022 and 2026 (Figure 4).

Figure 2. Activate Time Spent Estimates

Note: 1. Behaviors averaged over 7 days. Figures do not sum due to rounding. 2 “Other” includes media activities outside of the listed categories, such as browsing websites, reading, and attending live events. Sources: Activate analysis, Activate 2022 Consumer Technology & Media Research Study (n = 4,001), Company filings, Comscore, Conviva, Edison Research, eMarketer, Gallup, GWI, Interactive Advertising Bureau, Music Biz, National Sleep Foundation, Newzoo, Nielsen, NPD Group, Pew Research Center, U.S. Bureau of Labor Statistics, YouGov.

Figure 3. Excluding the COVID Bump, Long Form Video Consumption in the U.S. Has Been Stalled Out for Years at a Little Over 5 Hours Per Day

Source: See note for Figure 2.

Figure 4. Activate Forecasts Video Consumption Will Decline Over the Next Few Years

Source: See note for Figure 2.

Linear Monetization is About 2X Streaming

If consumption isn’t really growing, then the only way revenue can go up is if monetization increases. One problem, however, is that consumption is shifting to streaming from traditional and streaming monetizes at a much lower rate.

The chief reason is something that I’ve written before, namely that historically people were paying too much money for too much video. That is a vestige of the “forced bundling” of the traditional pay TV bundle, in which people were paying a lot for a lot of networks they didn’t watch.

As shown in Figure 5, between 1995–2015, cable prices rose about twice as fast as inflation. Plus, according to Nielsen, the number of networks that consumers viewed monthly actually declined over that period (falling from ~17 to ~12), even as the number of networks they received continued to climb (Figure 6).

Figure 5. Cable Price Increases Substantially Outstripped Inflation…

Source: FCC Report on Cable Industry Prices, Oct 12, 2016 via Cordcutting.com.

Figure 6. …And Subs Were Increasingly Paying for Channels They Didn’t Watch

Source: Nielsen.

Streaming, by contrast, is effectively unbundling the bundle by enabling consumers to assemble their own synthetic bundle (Netflix, Hulu, Disney+, HBO Max, etc.). Since they are now better able to select the services they use, this is better aligning consumption with expenditure.

Figure 7. Streaming Monetizes at a Lower Rate per Hour of Consumption

Source: Author analysis.

In One Clear Casualty, I showed the above chart (Figure 7), which illustrated that traditional linear TV monetized far higher than streaming. The data are outdated now, but fortunately (for me), SVB MoffettNathanson recently published a great chart with a similar analysis. As shown, they calculate that linear is monetizing at $0.57 per hour and the streamers range from $0.27–0.42 per hour (Figure 8). Taking the largest and most mature streamers, Netflix, Hulu and Disney+, we can see that the monetization per hour of streaming is less than half traditional TV.

The push into addressable advertising will likely help close the gap, at least a little. Both Netflix and Disney have indicated that the combined subscription and advertising ARPU from their advertising-supported subscribers exceeds the higher-priced ad-free plans, so growth in ad-supported subscribers should boost ARPU. But it would need to double ARPU to make up the difference.

Monetization per hour of streaming is less than half of traditional TV.

Figure 8. Linear and Streaming Revenue Per Consumption Hour from MoffettNathanson

Source: SVB MoffettNathanson.

Video Over-Monetizes Relative to Other Media

Another challenge is that video over-monetizes relative to other media too.

The way to calculate this is (simply?) by adding up all consumer revenue (transactions, subscriptions and advertising) for different media and divide that sum by total time spent for each.

Aggregate domestic consumer revenue for video, gaming and audio are shown in Figure 9. For video, this includes traditional pay TV subscription and advertising, streaming subscription and advertising (including AVOD and FAST, but excluding “social” or “short form” video like YouTube and TikTok), home video and box office. Gaming includes console, PC, mobile and in-game advertising. Audio includes recorded music (which includes physical, digital, streaming subscription and streaming advertising), terrestrial radio, satellite radio, podcast and audiobooks. Audio excludes publishing revenue (since this is not consumer revenue) and live events, to be consistent with the definition of audio time spent that Activate uses.

Figure 9. In the U.S., Total Video Revenue is ~4–5X Either Gaming or Audio

Source: Company reports, Morgan Stanley, Omdia, Box Office Mojo, Digital Entertainment Group, SensorTower, NPD Group, IFPI, RAB, eMarketer, IBISWorld, Author analysis.

Daily time spent for adults 18+ for each of video, gaming and audio was shown above in Figure 4. Figure 10 shows the divisor of aggregate revenue divided by annual time spent, or consumer revenue-per-consumption hour, for each of these media. As shown, the revenue per hour of video is almost 50% higher than gaming and almost 3X audio.

Figure 10. Video Monetizes at Almost 50% More Per Hour than Gaming and Almost 3X Audio

Source: Author analysis.

How reliable is this data? I have greater confidence in the revenue numbers, which are assembled from a variety of reputable sources and public information, than time spent. As mentioned, however, Activate has been assembling this data for years. Also, what matters here is the relative, not absolute figures. To think that the ratios between video, gaming and audio are far off the mark, one would have to believe that there is some miscalculation in the time spent data that skews one medium more than another. If anything, gaming (and perhaps audio) revenue-per-consumption hour is probably overstated. The Activate data only counts consumption among adults 18+ and, relative to video, kids likely account for a disproportionate amount of gaming consumption (and possibly music consumption too). As a sniff test, refer again to the MoffettNathanson analysis above (Figure 8). As shown, linear is $0.57 per hour and the streamers range from $0.27–0.42 per hour. Assuming that linear represents ~60% of consumption and streaming is 40% (in line with Nielsen data, shown in Figure 11), on a blended basis this yields about $0.45, pretty close to the $0.41 estimate above.

Figure 11. Excluding YouTube, Linear is About 60% of TV Viewing

Source: Nielsen.

Is this a fair comparison? Perhaps video should generate more revenue per hour than other media because it is a higher engagement medium and therefore consumers are willing to pay more for the experience. This is plausible, if debatable. It’s easier to make the case that video is higher engagement than audio than it is to argue it’s higher engagement than gaming, since audio is more likely to be consumed while multitasking. (As noted in Figure 2 above, the time spent calculated by Activate aggregates up to 32 hours per day, so there is a high degree of multitasking.) For gaming, playing a AAA console game is all consuming. Playing Candy Crush at the DMV, less so.

In any case, the analysis shows that video is starting from a high water mark. For overall video revenue to grow, monetization needs to grow. Relative to other media, it’s hard to argue that it should be monetizing at an even higher rate.

It’s Time to Move On

I once played golf with a guy who had an absurd slice. On the first tee, he aimed about 45 degrees left and proceeded to hit a big, looping slice that landed softly in the middle of the fairway. He picked up his tee, saw our expressions, and shrugged. “You gotta play the swing you have, not the one you wish you had.”

As someone who ran investor relations at a big media company, I understand the pressure companies face to be optimistic. But it’s time for the broader industry, and the companies themselves, to acknowledge the “swing they have:” TV distribution was disrupted and — since disruption definitionally means that one or more new entrants challenge the market with a lower-priced, lower-functionality offering — disruption is always deflationary. In some cases, the new entrants attract new customers who were previously priced out of the market and therefore still grow the overall pie. But pay TV was already at ~90% penetration in the U.S.; there weren’t a lot of non-consumers to attract. Which is to say, from the simplest perspective, the TV revenue pool — and, as a result, profit pool — will be smaller.

Whether or not streaming will “fill the hole” left by traditional TV is no longer relevant. The media companies’ most important job is to take the necessary strategic and operational steps to optimize the profitability of their current portfolio of businesses and leverage their IP, brands, audiences and capabilities to create new ones. Nostalgia for a fading business model only impedes that process.

¹ As I discussed in Revisiting Growth vs. Optimization, it is true that many international markets are dominated by one or two pay TV providers and streaming potentially opens these markets to the media conglomerates. But global expansion is also not for the faint of heart. Many of these markets have much lower ARPUs that the U.S. and Western Europe and require incurring significant losses for sustained periods — as evidenced by Disney’s recent retrenchment in India.