Video: Forecast the Money

Quantifying the Trajectory of Sports Rights in the U.S. and the Video Ecosystem's Ability to Absorb Them

I am now accepting sponsorships for The Mediator. If interested in sponsoring a post, please contact me here.

This post is sponsored by Isos7 Sports. Isos7 Sports, founded and led by a diverse management team, is a private investment platform that will provide capital to premium sports leagues and teams around the world that have multiple growth levers. Ownership groups and management teams will also benefit from the partners' history of value creation and operational expertise across sports and media properties to help transform business models and accelerate growth.

In a recent post (Video: Follow the Money), I took holistic look back at the U.S. video value chain.

With the U.S. video business under duress and continued increases in sports rights (punctuated by the massive NBA deal, which appears close to consummation), lately a debate has emerged whether we are in a sports rights “bubble.” One of my conclusions in that post was that we aren’t, especially for premier sports.

In this follow up, I look forward at the trajectory of sports rights in the U.S. and the video ecosystem’s ability to absorb them.

The primary conclusions are: 1) the ecosystem has more than enough headroom to absorb higher rights fees, even under pessimistic scenarios; 2) rights fees could be significantly higher than my “normal course” forecasts, especially if the video business proceeds along the bull case; and 3) rising sports rights are likely to squeeze out entertainment spend, maybe a lot.

Tl;dr:

Below, I forecast sports rights amortization in the U.S. through 2030 (based on ongoing contracts and “normal course” assumptions about increases on expiring contracts) and assess the video ecosystem’s capacity to absorb those increases under base-, bear- and bull-case scenarios.

The transition from pay TV to streaming is deflationary, because pay TV monetizes dramatically higher than streaming per household (3X for subscription fees and 7X for advertising). The differences between the base, bear and bull cases largely hinge on the pace of this transition and the degree to which streamers can close the monetization gap (through price increases, crackdowns on password sharing, bundling and a near-universal push into advertising).

The scenarios show that even under the bear case, the video business has plenty of overhead to accommodate higher sports rights costs.

I project that, under normal course, sports rights amortization will rise from about $24 billion in 2023 to about $40 billion in 2024. In the bear case, that means sports would represent more than 40% of total industry content spend by 2030, double the 20% it represented last year.

Should the bull case for the video business play out, sports rights would likely be even higher as some of this increased spending power would probably be allocated to sports (in the form of higher step ups, new packages and new leagues or sports).

Share of content spend will almost certainly shift to sports from entertainment under any scenario and, in the most pessimistic scenarios, will exert downward pressure on entertainment content budgets. In the base case, I calculate that entertainment content spend would decline at least 2% per year through 2030; in the bear case, it would decline 8%.

The ecosystem’s ability to accommodate higher sports spending is good news for the leagues, teams and players, but the growing relative importance of sports is another looming problem for an already-struggling Hollywood.

Revisiting the Rationale

The logic underlying why we might be in a sports “bubble” makes sense: financial pressures in the video business will ultimately affect media companies’ ability to afford the rights. Plus, while there have recently been several very bullish headlines for sports rights—such as the pending blockbuster NBA deal, Netflix’s acquisition of Christmas Day NFL games and Roku acquiring MLB rights—there have been a couple of yellow flags too, such as the arguably underwhelming outcome for NASCAR.

In Video: Follow the Money, I argued that sports rights are not in a bubble, especially for premier rights, because spend will likely be reallocated from entertainment content to sports. For the complete rationale, see here, but here’s a summary:

Sports are dramatically outperforming entertainment in viewership.

Sports are outperforming in monetization too—most notably, sports CPMs are rising faster.

At the same time, entertainment content is becoming more hit-driven and therefore riskier, while sports is as close to a sure thing as you can get.

Recent moves by Netflix to embrace advertising and Amazon’s more aggressive ad push makes them better bidders for sports rights, because now they can directly monetize the high viewership levels (and natural ad breaks).

Over the longer term, the advent of GenAI may both reduce entertainment production costs—which would free up resources to reallocate to sports—and, for the same reason, further reduce the relative value of entertainment content as it becomes more commoditized.

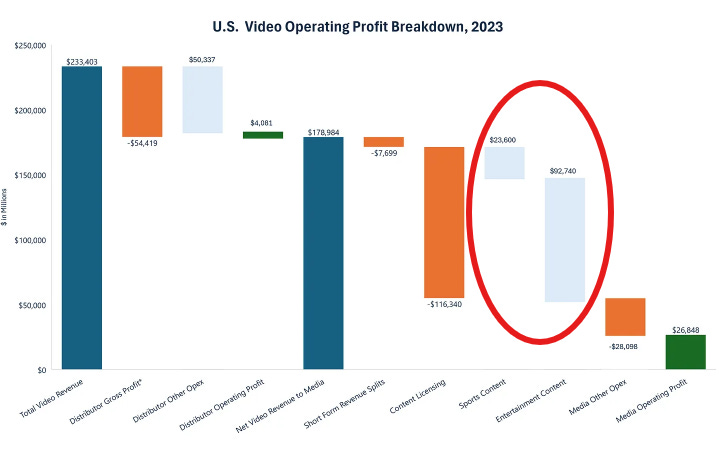

The most important point was illustrated in a graph, re-pasted as Figure 1 here, which quantifies the amount of money that is available to be reallocated. It shows that the U.S. video ecosystem spent about 4X as much on entertainment content last year as sports.

Figure 1. Media Companies Spent an Estimated $90 Billion on Entertainment Content Last Year

Note: *Distributors include pay TV distributors, theaters, local TV stations, media buying agencies, digital distributors (e.g., Apple and Amazon) and retailers. Source: Company reports, MoffettNathanson and Author estimates.

Below, I try to expand on this argument by quantifying the trajectory of U.S. sports rights and the video ecosystem’s ability to absorb those higher costs under several scenarios.

Projecting Sports Rights

This section assumes some familiarity with sports rights terminology and accounting. For a discussion of the differences between AAVs (annual average value), cash costs and amortization of sports rights as well as the pitfalls of analyzing “step ups,” see the Appendix below.

As shown in Figure 2, I estimate that the amortization for U.S. sports rights was $23.5 billion in 2023 and that this will increase to at least $40 billion in 2030. This “normal course” forecast is based on a few assumptions.

I assume that amortization schedules are based on 5% annual revenue growth. (As described in the appendix, sports rights amortization is an accounting decision tied to expectations about the growth of revenue attributable to the rights.) This reflects slower growth from traditional licensees and faster growth from streamers.

Estimates for the next NBA contract (starting the 2025-26 season) are based on the figures widely reported in the press.

As shown in Figure 3, after the pending NBA deals are inked, I assume that rights for the two largest leagues, the NFL and NBA, will be locked beyond the end of the forecast period, 2030. Together, these account for roughly half of all sports rights. It’s worth noting that the NFL reportedly has the right to opt out of most of its major rights deals in 2030, rather than allow them to terminate in 2033, but this would still result in them being set through the forecast period in Figure 2. (Note this excludes Sunday Ticket, which expires in 2029, and the recently-announced three-year Netflix deal.)

The remaining key sports rights that are subject to renewal over the forecast period include the MLB, NHL, UFC, WWE and certain soccer rights, including EPL (Figure 3). The forecasts in Figure 2 assume that renewals reflect “normal course” increases of 8% annually.

These forecasts are a starting point. As I describe below, under some scenarios, sports spend could be even higher. But we’ll get to that.

Figure 2. Sports Rights Amortization Should Rise to at Least $40 Billion by 2030

Source: Public reports, Author estimates.

Figure 3. After NBA, Major Renewals Over the Next Several Years Include MLB, NHL, UFC, WWE and Some Soccer Rights

Note: 1) Represents AAV step up in current deal compared to prior deal; 2) NWSL deal excludes production costs. Source: JP Morgan, Public reports.

Assessing the U.S. Video Ecosystem’s Capacity to Absorb Higher Rights Fees

So, based on existing contracts and normal course increases on expiring rights, sports rights amortization is set to almost double by the end of the decade. Will the video ecosystem be able to handle it? I think the answer is clearly yes, even under pessimistic scenarios.

In this section, I forecast a base, bear and bull case for total U.S. video revenue through 2030. Then, to determine the total industry content budget, I also assume that roughly 1/2 of all revenue is spent on professionally-produced content, consistent with recent years. While no one has a crystal ball, we can identify the key drivers, look at recent trends and then make a range of assumptions about those trends going forward.

Let’s start with the trends, then turn to the forecast scenarios.

Key Unit Trends

As shown in Figure 4, over the last decade or so, pay TV subscribers (the purple line) have fallen from about 100 million (in 2013) to 72 million (in 2023), or from 85% penetration of U.S. households to 55%. (This includes both facilities-based MVPDs, like Comcast and DirecTV, and virtual MVPDs, like YouTube TV and Hulu Live.) As can be seen in Figure 5, the pace of pay TV subscriber decline has accelerated in recent years and fell about 7% last year.

Pay TV subs are declining high single digits and streaming sub growth is slowing as streaming services per household starts to top out.

Over the same time frame, the proportion of U.S. households that subscribe to at least one streaming service have gone from almost none to almost 90%. The rate of premium SVOD (subscription video on demand) subscriber growth was still a very-respectable 10% last year, according to Antenna (“premium SVOD” includes Apple TV+, Discovery+, Disney+, Max, Hulu (SVOD-only), Netflix, Paramount+, Peacock and Starz) (Figure 6), although this rate of growth is also slowing. That’s because almost all broadband households now subscribe to at least one SVOD service, roughly 94% (Figure 4), and the number of streaming subscriptions per streaming household seems to be topping out around 4 (Figure 7). This figure grew rapidly from 2019-2020 due to the launch of several major new services (Disney+, HBO Max and Peacock) and, probably, COVID, but it has leveled off since.

Figure 4. Pay TV Penetration is Down to 55% of U.S. Households and Streaming Penetration is Nearing Saturation

Source: U.S. Census, ITU, FCC, MoffettNathanson, Parks Associates, Author estimates.

Figure 5. Pay TV Subscriber Declines Have Accelerated

Note: Includes traditional pay TV and vMVPDs. Source: MoffettNathanson, Author estimates.

Figure 6. Streaming Subscriber Growth is Slowing…

Note: Represents “premium SVOD,” defined as Apple TV+, Discovery+, Disney+, Hulu (SVOD-only), Max, Netflix, Paramount+, Peacock and Starz. Source: Antenna.

Figure 7. …As Subscriptions per Household Stall Out Around 4

Source: U.S. Census, Parks Associates, Ampere, Author estimates.

Key Monetization Trends

The next step is to look at recent trends in monetization, namely how much revenue both pay TV and streaming households generate, per household. Of course, there are two main sources of revenue: subscription fees and advertising revenues.

Keep in mind that there are a lot of variables that determine monetization per household, such as price increases, mix shift, etc. To calculate historical monetization per household, all I am doing here is dividing revenue each year by the average number of relevant households that year (e.g., total streaming revenue divided by average streaming households), which nets out these effects.

By monetization, I simply mean revenue (subscription or advertising) divided by the average number of relevant homes over the period.

Subscription

Starting with pay TV subscription fees, you can see in Figure 8 that monthly subscription revenue per pay TV household has stayed quite steady at ~$100 per month for years. This reflects price increases by the Comcasts, DirecTVs and YouTube TVs of the world, offset by mix shift to lower-priced packages.

Monthly subscription revenue per streaming household has more than doubled over this time period, to $28 in 2023 from $11 in 2016.1 This was driven in large part by increases in the number of streaming services per home in 2019-2020, but in the last few years growth has slowed (Figure 8).

To state what is obvious from the chart, pay TV subscription revenue per household is more than 3X streaming subscription revenue per household.2

Figure 8. The Average Pay TV Household Spends ~$100/Month vs. ~$30/Month for the Average Streaming Household

Source: Kagan/S&P Capital IQ, MoffettNathanson, Parks Associates and Author estimates.

Figure 9. The Average Pay TV Household Generates Advertising Revenue of ~$70/Month vs. ~$10/Month for the Average Streaming Household

Note: For simplicity’s sake, here I assume that all traditional TV advertising is attributable to pay TV households (even though there are some households that watch TV over-the-air and account for a small proportion of broadcast TV advertising). Streaming advertising revenue shown here comprises AVOD, ad-supported SVOD, FAST and CTV. It doesn’t include YouTube or other short form. Source: U.S. Census, Kagan/S&P Capital IQ, MAGNA, MoffettNathanson, Parks Associates and Author estimates.

Advertising

Figure 9 tells a similar story for advertising monetization.

Monthly advertising revenue per pay TV household bounces around $60-$70, depending on whether it is a political/Olympics year.

Monthly advertising revenue per streaming household has grown steadily over time, from only $1 in 2016 to $9 last year. That’s due to rising streaming viewership in streaming homes, more advertising-supported services (including the growth of CTV and FAST) and growing advertiser familiarity and trust in streaming inventory.

Note that the advertising monetization differential between pay TV and streaming per home is even more extreme, or ~7X.

Revenue Forecasts

Before getting into specific scenarios, let’s discuss what is happening conceptually.

Obviously, U.S. consumers are migrating from pay TV to streaming and, as a result, pay TV is declining and streaming is growing. And, as shown above, streaming monetizes at a much lower rate than pay TV. This wide gulf in monetization between pay TV and streaming is one of the main reasons that I have written for years that the profit pool of streaming is likely to be structurally much smaller than traditional TV (see One Clear Casualty of the Streaming Wars: Profit).

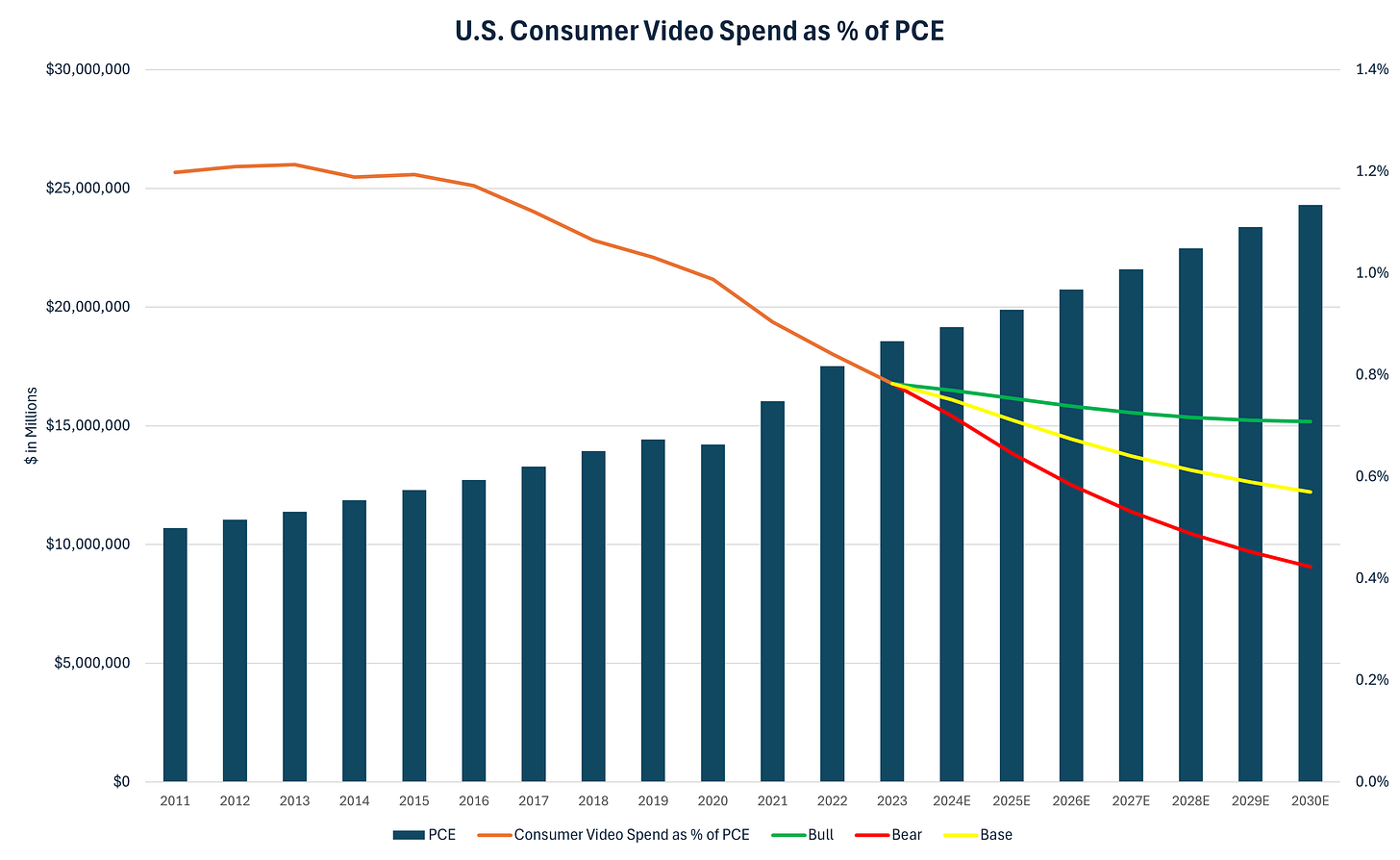

So, the net effect of the shift from pay TV to streaming has been deflationary for the U.S. video ecosystem (at least on a real basis). This can best be shown in Figures 10 and 11. Over the last decade, consumer video expenditures have fallen as a percentage of PCE (personal consumption expenditures) and video advertising revenue has declined as a proportion of total advertising spend.

Figure 10. Consumer Spend on Video Has Been Declining as a % of PCE Since 2014

Source: U.S. Bureau of Economic Analysis, Kagan/S&P Capital IQ, Box Office Mojo, DEG and Author estimates.

Figure 11. Video Has Been Losing Share of Ad Budgets Since 2015 Too

Source: U.S. Bureau of Economic Analysis, MAGNA, MoffettNathanson, and Author estimates.

However, there is also good reason to believe that streaming monetization is artificially depressed and will pick up from here. After years in which streamers’ were chiefly focused on subscriber growth, in the last year or two, all of them have shifted their attention to profitability instead (see Media’s Shift from Growth to Optimization).

As all the streamers shift focus to profitability from growth, streaming should start to more rapidly close the monetization gap with traditional TV.

This shift from a focus to monetization and away from unit growth is a natural and inevitable part of the lifecycle of all platform businesses. All businesses benefit from scale and initially focus on attracting customers. But once they reach critical mass and/or the marginal benefit of adding more customers starts to decline, they try to make money. For platform businesses, this is what Chris Dixon calls the transition from Attract to Extract (Figure 12).

Figure 12. All Businesses Eventually Focus on Monetization

Source: Chris Dixon.

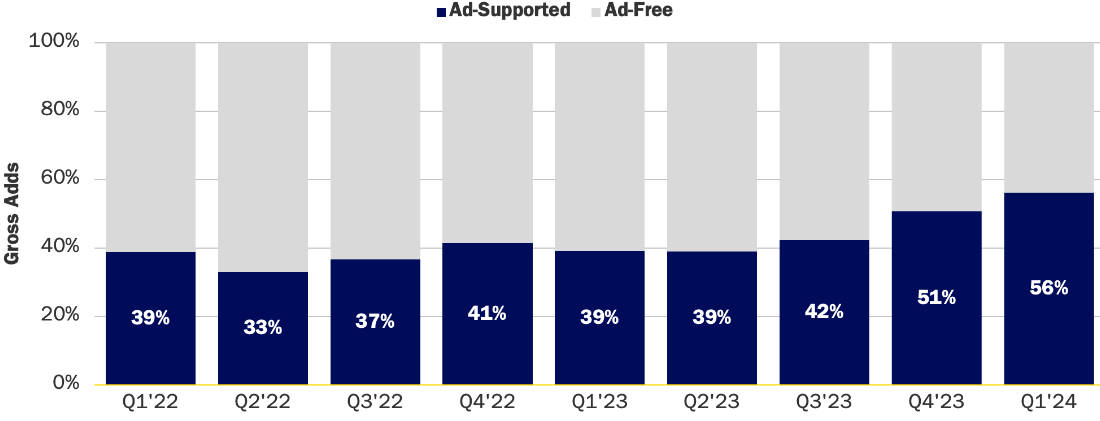

According to script, all the streaming services have been raising prices in recent years (Figure 13). In addition, other than Apple TV+, all now offer advertising-supported tiers. (Disney and Netflix launched ad-supported tiers in late 2022 and Amazon chose to default all Prime subscribers into an ad-supported service a few months ago.) Netflix recently disclosed that, in markets with ad-supported tiers, about 40% of gross ads are choosing them. More generally, as shown in Figure 14, according to Antenna, the proportion of gross adds that opt for the ad-supported tiers increases every quarter (note that this data excludes Amazon Prime Video). So, streaming should start to close the monetization gap with traditional pay TV. The question is how much, something I discuss below.

Figure 13. Streaming Prices are Going Up

Note: Ad-free tiers, where relevant. Source: Public information, via Forbes.

Figure 14. The Proportion of Gross Adds Opting for Ad-Supported is Also Climbing

Note: Proportion of gross adds for select ad-supported SVOD services. Includes AMC+, Apple TV+, BET+, Discovery+, Disney+, Hulu (SVOD-only), Max, Netflix, Paramount+, Peacock and Starz. Does not include Amazon Prime Video. Source: Antenna

So, the key drivers3 of our forecasts are:

pay TV homes (or subs, which are synonymous);

subscription revenue per pay TV home;

streaming services per streaming home;

effective streaming price increases;

ad monetization per pay TV home;

and ad monetization per streaming home.

I created a base, bear and bull case for each of these key drivers and calculated U.S. video ecosystem revenue and content spend for each scenario. The drivers are summarized in Figure 15.

Figure 15. Summary of Assumptions for Bear, Base and Bull Cases

Source: Author.

Pay TV Homes

As noted above, pay TV homes (or subs) declined by 7% in 2023.

Base. They continue to decline at this rate through 2030, which would reduce the number of subscribers to 42.5 million by then.

Bear. The argument for worse is that more sports migrates outside the pay TV bundle and strapped media conglomerates move further into cash preservation mode and starve their linear networks of much new investment. Both would reduce the relative value of traditional pay TV.

Bull. The bull case for a moderating rate of decline is that the advent of new combined pay TV and streaming packages, such as the landmark Charter-Disney deal, and new smaller packages, such as the “Venu” joint venture of Disney, Fox and WarnerBros. Discovery, will staunch the bleeding (even if the latter exerts downward pressure on revenue per home).

Pay TV Subscription Revenue Per Home

As also noted above, pay TV subscription revenue per home has been remarkably stable for years at around ~$100.

Base. This stability continues.

Bear. The argument for lower average revenue follows from the last point: even though providers will likely continue to raise prices, average revenue may decline if a significant number of subscribers downgrade to lower-priced, smaller (e.g., sports-dominant) packages.

Bull. Distributor price increases stick and average revenue climbs modestly.

Streaming Subscriptions

As noted before, almost everyone who has broadband pays for at least one streaming service. Streaming penetration of total U.S. households is almost 90% and penetration of broadband households is close to 94% (Figure 4). As a result, growth in streaming subscriptions will be almost entirely driven by growth in streaming services per home. As also shown above (Figure 7), while services per home spiked around the launch of new services in 2019-2020 (Disney+, HBO Max/Max, Peacock, etc.), growth has slowed in recent years.

Here, the base case is that it climbs slightly (driven in part by crackdowns on password sharing and more attractive bundles), the bear case is that it remains fixed at the current level and the bull case that it grows a bit faster.

(Effective) Streaming Pricing

Streaming pricing is a function of price increases and mix shift between packages. Here, I show a base, bear and bull case of 5%, 3% and 7% effective annual increases, respectively. Most streamers are now pushing through mid-to-high single digit annual increases, but a mix shift toward lower-priced ad-supported plans would offset this.

Video Advertising

The future trajectory of video advertising is perhaps the most complex (and maybe divisive) issue. The key questions are whether advertising on professionally-produced video (whether delivered through traditional TV or streaming) can reverse the loss in relevance to brand advertisers in recent years and attract new advertisers.

Since TV has not historically supported interactivity, it has been relegated largely to brand advertising budgets (“top-of-funnel”), while digital (search, social, retail media, etc.) competes along the full funnel.4 In theory, the shift to streaming video (AVOD, ad-supported SVOD, FAST and CTV), which is interactive, has made it possible for professionally-produced video to compete up and down the funnel. In practice, this hasn’t happened. Advertiser spend on platforms like Hulu, Pluto or Roku has been almost entirely reallocated from traditional TV. It has not attracted more performance-oriented mid- and bottom-of-funnel advertising budgets.

In addition, professionally-produced video has been falling out of favor even among brand advertisers. This can be seen in Figure 11 above. Video advertising (which includes traditional TV and streaming) has been declining as a percentage of total ad spend for close to a decade.

As a result, forecasts for both advertising per pay TV home and streaming advertising per streaming home must reflect a view about whether video can or can’t reverse recent trends.

Advertising Per Pay TV Home

As shown above (Figure 8), traditional TV advertising per pay TV home has been steady or risen slightly over the past decade. That reflects both higher CPMs and lower viewing per pay TV home (i.e., viewing is falling even for those customers who “keep” the cord).

The base, bear and bull cases all show little variation around this trend. Is it possible that the demand curve for advertising is kinked at some level of pay TV distribution and, once reach falls enough, advertisers will flee TV even faster, pulling down pricing? Sure. But that’s tough to model.

Advertising Per Streaming Home

All three scenarios for advertising per streaming home show healthy growth through the end of the decade. There are a few reasons:

1) As noted above, with recent launches of ad tiers by Netflix and Disney and Amazon’s decision to give everyone ads by default, there is a lot more inventory coming on line.

2) While streaming ad inventory per hour is much lower than traditional TV (~4 minutes per hour, according to Brian Wieser, versus about 14 on broadcast and 16 on cable), some streamers have hinted they might increase ad inventory.

3) Streamers have started to link up with retailers, such as the recent partnership between NBCU and Instacart. Retail Media Networks (RMNs) have attracted large proportions of CPG ad budgets in recent years (Figure 16) because they can use their first-party data to offer targeted ads and they offer “closed loop attribution,” the ability to directly tie an ad impression with a purchase. For RMNs, partnering with streamers would add high-quality inventory.

4) Following on the prior point, Amazon Prime now directly marries video inventory with commerce capabilities, which positions it extremely well to attract performance budgets (at least from CPG advertisers who sell goods on Amazon).

Figure 16. Retail Media is Set to Overtake Traditional TV

Source: GroupM, via The Wall Street Journal.

For all these reasons, advertising monetization on streaming should expand significantly over the next few years. How much?

Base. The base case is that streaming advertising per streaming home reaches half the level of TV, or about $35 monthly by 2030.

Bear. It only gets to $25.

Bull. It reaches $45, or roughly 2/3 of traditional TV.

Figure 17. Revenue and Content Amortization in Bear, Base and Bull Cases

Source: Author estimates.

The Bottom Line

Figure 17 shows U.S. video ecosystem revenue estimates that correspond to the base, bear and bull case assumptions in Figure 15. Under the base case, video revenue (ex. YouTube5) is flat nominally throughout the remainder of the decade, consistent with the trend since 2016 (Figure 18).

Figure 18. In the U.S., Total Video Revenue Hasn’t Grown Over the Last Decade

Source: Kagan/S&P Capital IQ, MAGNA, MoffettNathanson, OMDIA, Box Office Mojo, DEG and Author estimates.

Figure 17 also shows the corresponding estimates for content amortization (for professionally-produced content) for each case, which assume that ~50% of video revenue (ex. YouTube) is spent on content, in line with recent years. It pulls in the normal course forecasts for sports rights amortization from Figure 2 above and, under each case, calculates what would be left over. In any scenario, sports would be a rising proportion of content expenditures. In the bear case, forecasted sports rights amortization would be ~40% of total content spend in 2030, about double from 20% in 2023.

As shown in Figure 19, under the base and bear cases, rising sports rights amortization would not just take share, but would put downward pressure on entertainment spend. In the base case, I calculate that entertainment content spend would decline at least 2% per year through 2030; in the bear case, it would decline 8%. In the bull case, some of this residual spending power would likely be allocated to incremental investments in sports (in the form of higher steps ups than I modeled in Figure 2, additional rights packages and/or leagues).

Figure 19. In the Base and Bear Cases, Sports Costs Would Exert Downward Pressure on Entertainment Spend

Source: Author estimates.

Stress Testing the Forecasts

Figures 20 and 21 put the base, bear and bull cases in broader perspective. As noted before, video subscription spend has been declining as a percentage of PCE and video advertising spend has been declining as a percentage of total advertising budgets for almost a decade.

Figures 20 and 21 show that the base case implicitly assumes that video continues to lose share of PCE and is able to stem its share loss of TV ad budgets, respectively. Note that even in the most bullish case, neither measure gets back anywhere close to the historical peak.

Even my bull case doesn’t assume that video re-approaches its high water mark for consumer spend as a proportion of PCE or share of ad budgets.

Figure 20. The Base Case is That Video Continues to Lose Share of PCE…

Source: U.S. Bureau of Economic Analysis, Kagan/S&P Capital IQ, Box Office Mojo, DEG and Author estimates.

Figure 21. …And Can Maintain Share of Ad Budgets

Source: U.S. Bureau of Economic Analysis, MAGNA, MoffettNathanson, and Author estimates.

Puts and Takes

Forecasts tend to be pretty linear, but the world is not. Could a demand curve be kinked? Could there be some exogenous shock to the system? Unforeseen consumer behavior shift? Major change in market structure? Technological innovation? Sure, sure, sure, sure and sure. The challenge is that it’s hard to model non-linearity in any non-arbitrary way. I don’t want this to read like the mealy-mouthed risk section of a 10-K, but let’s discuss some of the puts and takes that could lead to more bearish and bullish outcomes than I outlined above.

Models are usually linear, while the world is not.

GenAI

I have written a lot about the potential effect of GenAI on the TV and film businesses (a quick summary is here). On the one hand, it could reduce entertainment content production costs; on the other, collapsing barriers to entry might make it economically feasible to distribute high quality content for “free” (i.e., ad-supported) on platforms like YouTube and TikTok and further reduce consumers’ willingness-to-pay for subscription video, pressuring the ecosystem even more than the bear case I show above. In the latter case, it’s impossible to predict how that would affect the ecosystem’s capacity to absorb higher sports rights. The good news is that consumers will likely always be willing to pay for sports (even if they are willing to pay for nothing else).

Consolidation

The effect of consolidation is also unanalyzable. The traditional video business is under duress and I think it is unlikely that monoline video companies, like Paramount and WarnerBros. Discovery, will be independent in a few years. Consolidation would almost certainly reduce the number of competing general entertainment streaming services. That would probably increase the pricing power of the remaining services and possibly reduce churn, both of which could be very healthy for the ecosystem. But it’s impossible to predict how the deck might be reshuffled or whether the regulatory environment would permit it.

Consolidation could increase streaming services’ pricing power and lower churn, which would be a boon to the ecosystem.

The Profit Motives of the “Platforms”

As noted above, my forecasts for content spend assume that it remains about 50% of total industry revenue. However, just as it seems unlikely that most monoline video companies can remain independent, it seems likely that revenue will shift to multiline companies, for which video is just one business (i.e., Amazon, Apple, Disney, Comcast). These companies may be willing to operate at even lower margins, as they effectively use video to cross subsidize something else. For instance, Amazon may find that Prime Video viewers spend more money on merchandise; Apple may find that Apple TV+ viewers own more Apple devices; Disney may find that Disney+ subscribers are far more likely to visit the parks, etc. These companies may be willing to allocate even more money to content, pushing this ~50% assumption higher.

Sports Will Almost Certainly Take Share of Spend

The idea that sports are becoming more valuable hardly needs to be litigated. In just the last few weeks, we’ve gotten more confirmation that both NBC Universal and Amazon are eager to pony up for the next contract; Netflix has secured a three-year deal with the NFL to air games on Christmas Day; and Roku has acquired multiyear rights to the MLB Sunday Leadoff game. What’s remarkable about all these examples is that they are all new bidders for rights they didn’t previously hold. It’s one thing for a network or streamer to pay up to retain rights for defensive reasons; it’s quite another for one to make a large new investment in sports.

In the last few weeks, multiple new bidders for sports rights have emerged.

Despite this, it’s fair to wonder whether the rising pressure in the video ecosystem will eventually come home to roost. Eventually is a long time, of course, as eventually the Sun will die and we probably won’t care much about sports rights or Netflix’s stock price. In the medium term, however, the above analysis shows why there remains ample room to accommodate higher sports rights, even under relatively pessimistic scenarios for the video business.

Sports looks likely to gain share of overall content spend, the only question is how much. On balance, that’s more bad news for the entertainment industry in Hollywood, which is already struggling after last year’s strikes and a general pull back as buyers tighten their belts.

Appendix: A Brief Discussion of Sports Rights Terminology

Typically, when people talk about the value of sports rights, they are referring to the average annual value (AAV) over the life of the contract. For instance, this is from Lucas Shaw at Bloomberg:

The National Basketball Association is close to signing new long-term broadcasting agreements that would pay the league about $76 billion over 11 years, or three times its current deal.

The league has agreed to the general framework of deals with Walt Disney Co. and Amazon.com Inc. that are worth $2.6 billion and $1.8 billion a year, respectively, according to people familiar with the terms.

These latter figures are AAVs. That’s convenient shorthand, but keep in mind that, in any given year, both the cash payments from the licensee (network or streaming service) to the licensor (league or team) and the amortization of those rights (on the licensee’s income statement) may differ significantly from the AAV.

The schedule of cash payments is established during the rights negotiation and is not usually (or, as far as I know, never) disclosed. The leagues may have reasons they either want to front-load or back-load the cash payments. In theory, they could be straight-lined over the course of the contract, in which case they would equal the AAV every year. But they are often subject to some sort of annual escalator, so that the payments in the early years of the contract are lower than the AAV and higher in the out years.

Amortization also isn’t disclosed. Amortization is an accounting decision by the licensee and is tied to its internal forecasts about the revenue attributable to the sport over the life of the contract. Plus, those forecasts change all the time, so the amortization may also change. This can lead to some surprising outcomes. For instance, while usually most incremental advertising revenue falls right to the bottom line, this isn’t always the case for sports. Let’s say that one year the NBA postseason has an unusually large number of series that go seven games on TNT. That would be good for the network, since it would have more ad inventory and ad revenue associated with those games, but because it would be considered an aberration, the finance staff would probably also increase the rights amortization that year, so it wouldn’t necessarily result in much higher profit.

While the cash payments could equal the AAV every year, in most years the amortization does not. If one assumes that the revenue associated with the contract grows over time (these days, say 5%), then the amortization in the early years is lower than the AAV, it roughly equals the AAV somewhere in the middle of the contract, and it is higher by the end.

As I mentioned, my goals above were to forecast the trajectory of sports rights and then determine the video ecosystem’s capacity to absorb them. Since that is based on my forecast of a (simplified) video ecosystem “income statement,” the relevant figure is not the AAV, but the annual amortization of sports rights.

For our purposes, the relevant amount is the annual amortization of rights, not the AAV.

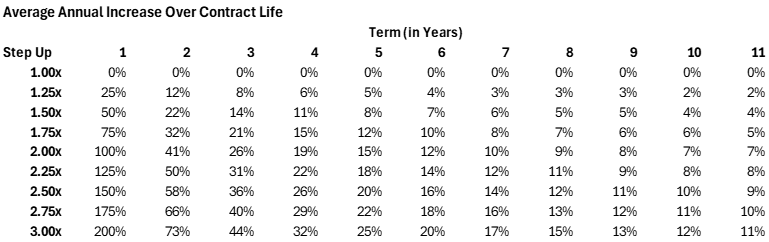

This brings us to the next convention, the concept of the “step up” in AAV, or the increase in AAV from one contract to the next. (A 1.5x step in AAV means it is up 50% from one contract to the next, 2.0x means it is double, etc.) Even though step ups are often discussed in the press, they don’t mean much in isolation, because they don’t tell you the annual average increase over the life of the contract. That depends on both the step up and the term (or length) of the contract. For instance, a 1-year contract with a 2.0x step up would have a 100% annual increase over its (one-year) life; a 10-year contract with a 2.0x step up would have a ~7% compounded annual average increase (Figure A1). (The compounded annual average increase is calculated as the (Step Up) ^ (1/n)-1, where Step Up is calculated as the new AAV/prior AAV and n = the term of the contract in years.) So, comparisons of AAV from one contract to the next are somewhat deceptive or at least incomplete.

When discussing sports rights forecasts above, I referred to an assumed average annual increase for new contracts, not an assumed “step up.”

Figure A1. The Relationship of Step Up, Contract Life and Average Annual Increase

Source: Math

This $28 estimate is derived by dividing total streaming subscription revenue (note that S&P Capital IQ/Kagan estimates $38.3 billion and OMDIA estimates $37.1 billion) by average number of streaming households. It may seem low, but keep in mind that most U.S. households have Amazon Prime Video, which is not counted in these revenue figures.

You may be trying to reconcile how the average streaming household subscribes to ~4 SVOD services, but also generates only $28 per household in subscription fees, which averages only $7 per service. (In 1Q24, Netflix ARPU alone was almost $17.) A key part of the answer is that my streaming subscription revenue estimates do not include any revenue contribution from Amazon, under the assumption that almost all Amazon Prime Video subscribers get it through their Prime subscription and don’t pay a discrete fee. Prime Video had an estimated 72 million viewing households at the end of 2023, which accounts for 0.6 services per streaming home, out of the 3.9 average. In addition, this 3.9 includes niche SVOD services, which are usually lower-priced.

Our video ecosystem forecasts also include estimates for box office and home entertainment, but these don’t really move the needle.

Advertisers spend money to attract customers and ultimately persuade them to take an action (like make a purchase). This gives rise to the concept of the “marketing funnel": the top of funnel is where advertisers build awareness and brand equity (“brand advertising”); mid-funnel is where they build relationships and foster consideration; and bottom of funnel is where they promote a call to action.

See Video: Follow the Money, for an explanation of why I include YouTube U.S. advertising revenue, but not other short form, like TikTok and Meta’s Reels.

Thanks Doug. Very thoughtful way to characterize the inflation in sports rights.