Will Radio Save the Video Star?

How Music Labels Have Stayed Dominant in an Infinite Content World

[Note that this essay was originally published on Medium]

In recent months, I’ve been writing about “infinite TV,” which I first laid out in Forget Peak TV, Here Comes Infinite TV. The idea is that several technologies, particularly virtual production and AI-assisted tools, are set to dramatically reduce the barriers to create high quality video content over the coming years. If correct, just as the last decade in the TV and film businesses was about the disruption of video distribution, the next decade will be about the disruption of content creation.

It’s difficult to think through all the implications for the media conglomerates, especially when considering that they’re still grappling with the disruption of distribution initiated by Netflix over a decade ago. But there is an analog that may provide clues: the major music labels.

In music, both distribution and creation have already been disrupted. There is already a practically-infinite supply of music. Nevertheless — in one of the more surprising outcomes in the media business in recent years — the major labels have maintained or even strengthened their role in the value chain.

Below, I explore why and what lessons this may, or may not, hold for the media conglomerates if video follows a similar path.

Tl;dr:

How will the media conglomerates be positioned if falling barriers to content creation result in an “infinite TV” world?

There is a clear analogy: major music labels.

Essentially, both labels and studios are intermediaries between creators and consumers. They provide services (financing, marketing, access to IP, artistic development, distribution, etc.) that attract the talent that makes the content. The key question for both is whether they can retain their roles in the value chain as it becomes easier for artists to perform these functions on their own.

The labels can answer that question today. In music, technology has radically lowered the entry barriers for independent artists and the supply of music is already effectively infinite.

The labels unquestionably face challenges as the supply of music explodes and artists’ bargaining power increases. Nevertheless, the labels remain dominant, as measured by market share, profitability and ability to attract top talent.

Among the key reasons are that the labels help artists manage the incredible (and rising) complexity of the music business, they control critically important catalog rights and they have substantial bargaining power over the streaming services.

The continued dominance of the major labels strikes a hopeful note for the media conglomerates, but a compare and contrast also shows why the conglomerates are at greater risk of disintermediation.

The Inevitability of Falling Barriers in High Quality Video Content Creation

Before digging into the current dynamics in the music business, I’ll revisit why I think it’s inevitable that the barriers to entry to high quality video creation will fall.

If you include “user generated” or “creator” content (terms I’ll use interchangeably), there is already effectively an “infinite” amount of video. (A quick note: I use quotes around “infinite” because while there is not literally an infinite amount of content, it is infinite in the sense that it could not be consumed in any one person’s lifetime, or even a hundred lifetimes.) In 2019, YouTube disclosed that 500 hours of video are uploaded to the platform every minute, or 30,000 hours per hour (Figure 1). The number has surely increased since then, but even so, it’s equivalent to Netflix’s entire library, every hour.

Figure 1. A Surely Outdated Number: 500 Hours of Video Uploaded to YT Every Minute

Source: Tubefilter, May 2019.

For most people, however, professionally-produced (“Hollywood” or “premium”) content and creator content don’t really compete. They are considered to be of far different quality and have different use cases. A lot of creator content is instructional videos about how to apply grout or change the battery in your key fob, makeup tutorials, site gags, Minecraft videos, dancing, hot sauce challenges and the like. My assertion is that, over time, creators will be able to make programming of comparable quality and serve similar use cases, dramatically increasing the supply of premium content.

From one vantage point, this may seem far-fetched or naïve. If you work on the creative side of TV or film production, you know first hand how many elements need to come together to create compelling long-form narrative programing. One person writes an article or even a book; today one solitary musician can cut an album (even on his phone). But it often takes hundreds or even thousands of people to create a TV series or movie. And it’s not just the sheer number of people. Writers, actors, directors, showrunners, the DP, costume and set designers, makeup, music composers and VFX artists, among others, all bring a different creative sensibility that must somehow alchemically combine to tell a cohesive story.

The arc of technology suggests it’s only a matter of time.

From another vantage point, though, it’s not so far-fetched: the arc of technology. To be more precise, I’ll draw a distinction between the effect of technology on media distribution and media creation.

The combination of digitization and the Internet had a similar effect on the cost of distribution for all media. Digitization was the great equalizer because it made the atomic unit of all information goods the bit. The Internet triggered a series of innovations (fiber and broadband wireless infrastructure, compression algorithms, rapidly declining storage costs, content delivery networks, etc.) that set the cost to distribute those bits on a path to zero, which ultimately affected all forms of media. The speed with which it affected each was a function of their bandwidth-intensity — it takes orders-of-magnitude fewer bits to distribute a book than a movie — but even for the most bandwidth-intensive content, it was only a matter of time.

By contrast, technology’s impact on the cost of creation for different media has been different for each form of media. The cost to create text fell long before the advent of the Internet, owing to the paper mill, the typewriter or word processing software, take your pick. The cost to create music fell owing to digital audio workstation (DAW) software and improvements in in-home hardware, like microphones and digital keyboards. The cost to create photos fell primarily due to advancements in hardware, namely the inclusion of ever-higher quality digital cameras within mobile devices, and then editing tools.

Is there something inherent to video that makes it immune to the effects of technology on every other form of media?

Because different technologies have been involved in each case, it may give the impression that somehow video is insulated. But here’s the question: is there something inherent to video that will make it immune to the dynamics that have affected every other form of media? I think the answer is no. Driven largely by the Cambrian explosion in AI, new video creation tools are proliferating at an almost alarming pace. To get a sense for what these tools already enable, and how fast they are moving, check out this running Twitter thread.

Digital Music, as Analog

This concept — infinite TV — is still very early and it raises a lot of questions. One question is: what happens to the biggest video companies, like Disney, Netflix, WarnerBros. Discovery, NBCUniversal and Paramount in this environment?

There is no easy answer, but a helpful analog may be music. The barriers to entry in music have already fallen and supply is already effectively infinite. Spotify boasts 11 million artists (as of 4Q21) and 100 million tracks. An estimated 100,000 new songs are uploaded to streaming services each day. Assuming three minutes per track, that equates to more than three hours of new music uploaded per minute.

Or, put it this way: in April 2019, Spotify said that nearly 40,000 tracks were uploaded daily; in February 2021 it said 60,000; and, as mentioned, that figure is up to 100,000 now. Taking 60,000 as the average over that period, that yields 22 million new tracks per year, implying that half (or perhaps more) of tracks currently on Spotify were added in the last three years.

Probably half (or more) of the tracks on Spotify were added in the last three years and three hours of new music are uploaded to streaming services every minute.

In music, the clear analogy to the major media conglomerates is the major music labels, Universal Music Group (UMG), Sony Music Entertainment (SME) and Warner Music Group (UMG). Just like the major studios, they are the “establishment,” with large balance sheets, massive catalogs of content, IP, a long history of talent and distribution relationships and a deeply entrenched role within the value chain. And those roles are broadly similar. Neither the studios nor the labels create content, they provide services (financing, marketing, artistic development, distribution, etc.) that attract the talent that creates the content. Both are essentially intermediaries between content creators and consumers, whose role and value is predicated on the historical difficulty for creators to produce content and reach consumers independently.

Neither the labels nor studios create content, they enable creatives to do something they can’t (or couldn’t previously) do by themselves.

So, how have the labels fared and what lessons does this hold for the media conglomerates?

The Labels Have Been to Hell and Back

The labels have witnessed enormous change over the past two decades.

Recorded music essentially didn’t grow for 20 years. Figure 2 is probably the most-oft-reproduced chart in music, the famous International Federation of the Phonographic Industry (IFPI) chart of global recorded music revenue. I won’t belabor the history here, which is very well known: the music labels formerly bundled singles into relatively expensive albums; the Internet enabled both cheap digital distribution and piracy; piracy exploded, facilitated by services like Napster and Limewire; in the face of growing piracy, the labels reluctantly licensed to Apple the rights to sell individual singles digitally (effectively unbundling the album); and then they licensed to subscription streaming services, like Spotify. As shown, revenue declined (on a nominal basis) between 2001–2014 (as sales of physical media plummeted) and, although it has grown since, it didn’t surpass the 2001 total until 2021. This rebound was driven by the growth of subscription and ad-supported streaming, which has more than offset declining physical and dwindling digital sales.

Figure 2. Recorded Music Revenue Took 20 Years to Surpass Its Prior Peak

Source: IFPI.

There is a near-infinite amount of (non-label) music. Not surprisingly, the vast majority of music now exists outside the major label system. Spotify estimates that only 200,000 of the 11 million artists on the platform are “professional” musicians, implying the other 98+% are not represented by any label, major or independent. (Some non-trivial portion of the 100 million tracks on Spotify is also “functional” background music, for studying, working, relaxing, etc., a growing proportion of which is created by AI.) While professionals are probably much more prolific on average, between all these non-professionals and functional music, it’s a safe bet that the major labels represent less than 10% of the tracks on services like Spotify and this percentage falls every day.

The major labels probably represent less than 10% of the tracks on Spotify and this percentage falls every day.

The value proposition of music labels to artists has also changed dramatically in recent years. Historically, among labels’ primary value proposition to artists was that they financed production, managed the complex logistics of physical distribution and handled marketing. Technology has diminished the importance of each of those roles. Now, DAWs, music creations services like Splice and LANDR and cheap home hardware can transform any bedroom into a studio; musicians can self-distribute directly on some streaming platforms or through digital distributors like TuneCore, DistroKid or CD Baby; and independent artists can build up large followings on social.

If you foresaw each of these dynamics, say, ten years ago, and were asked to predict the importance of major labels today, what would you have guessed? You probably would’ve guessed wrong. At least, I would have.

Labels Extract Most of the Value out of the Value Chain

The major labels are still dominant despite all these changes, and by some measures more so. Let’s look at it a few ways.

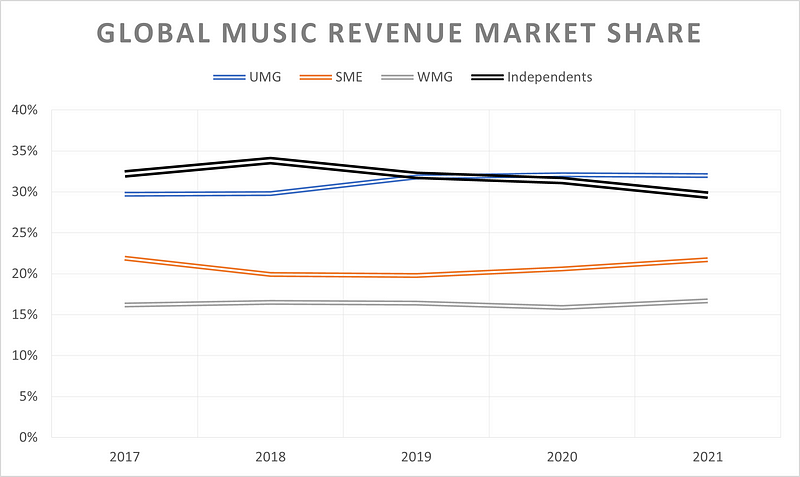

Revenue Market Share

Figure 3 show’s Omdia’s estimates for recorded music revenue market share globally. As shown, the shares of each of the majors tends to move around year-to-year, driven in part by hits, but collectively their share now exceeds 70% of all revenue and is climbing. Independents’ revenue share (which is to say all non-major labels) has been declining since 2018.

Figure 3. The Majors Are Dominant and Have Been Gaining Revenue Share

Source: Omdia (Music & Copyright).

Consumption Share

Alternatively, Figure 4 shows the share of streams (not tracks) on Spotify for the three majors plus Merlin (which includes some independent labels and distributors, like DistroKid). It shows that collectively this share has declined each year since 2017, but it still hovers near 80%. Also, note that the pace of decline has slowed in recent years, even as the rate of daily uploads to Spotify has increased.

Figure 4. The Majors and Merlin Still Have ~80% Share of Spotify Streams, Even with 100,000 New Tracks Uploaded Daily

Source: Spotify Form 20-F.

Operating Margins

Here’s another way of looking at it: operating margins. Figure 5 shows the margins for each of the majors over the last eight years. They’ve also bounced around year-to-year, but if you squint, the general trendline is up.

Figure 5. Generally, the Majors’ Operating Margins Have Been Climbing

Note: WME results for F2020 normalized for one-time expenses totaling $658MM. WME on September fiscal year. SME is divisional operating margin, excluding intersegment eliminations and corporate overhead allocation. SME on a March fiscal year, but these figures refer to the prior year (e.g., 2022 reflects F2023, ended March 31, 2023). Source: Company reports.

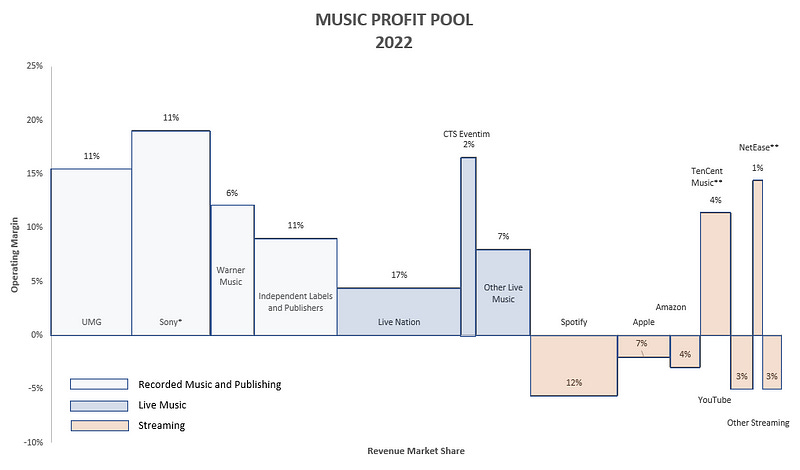

Profit Pool Analysis

Here’s my favorite (maybe because it was the toughest to pull together): a holistic look at the distribution of operating profits within music, between major and independent labels and publishers; promotion and ticketing; and digital service providers (DSPs), a.k.a. streamers (Figure 6). (Note that since all the majors have both recorded music and music publishing operations, I didn’t break out recorded music from publishing.) In this analysis, the x-axis is the share of total industry revenue for each company or category and the y-axis is its operating margin, so the operating profits (or losses) for each is represented by the area of the box. As shown, the labels extract the lion’s share of operating profit out of the value chain.

Figure 6. The Labels Extract Most of the Value in Music

Note: Public company figures are for fiscal years, not normalized where fiscal year differs from calendar year. *Sony (SME) is divisional revenue and operating profits, excluding intersegment eliminations and corporate overhead allocation. ** Includes social entertainment. Source: Company reports, PWC, Midia, Author estimates and analysis.

Ability to Attract Talent

Lastly, here’s perhaps the most important measure of the labels’ dominance: their continued ability to attract talent. Today, almost all new acts emerge from the tail of self-distributed music. Billie Eilish and her brother Phineas famously recorded her Grammy-winning album in his bedroom. Chance the Rapper, arguably the most successful independent musician, has 18 million followers on Instagram. He doesn’t need help with marketing. And anyone can — and it sometimes feels like everyone does — upload their own music to Soundcloud or, with a little work, Spotify.

Almost all new acts today emerge from the tail of self-distributed music — but they are quickly co-opted within the major label system.

Nevertheless, once an independent artist hits it big, generally the first thing they do is sign a major label deal. For instance, here’s a list of the Billboard top new artists for the last few years (Figure 7). Almost all of them (other than Olivia Rodrigo, who was already a Disney Channel star) started out by self-distributing and all now have major label representation. These deals are probably much more advantageous for these artists than what was available to emerging musicians 10 years ago, something I discuss below. But that they find it compelling to sign a major label deal at all is telling.

Figure 7. All of the Billboard Top New Artists of the Last Few Years Have Major Label Deals

Source: Billboard, Author analysis.

Why are Labels Still So Important?

The obvious question is why the labels’ role in the value chain has proved so resilient. There are a few key reasons:

Validation

This is self explanatory. Long predictions of the waning influence of major labels aside, signing a major deal is still an important sign of validation, especially for an emerging artist.

Complexity

The music business is incredibly complex. Labels help navigate all this complexity, supported by teams of experienced people, long industry relationships and data.

The rights framework is notoriously byzantine, with separate rights for recorded music and compositions and multiple sub-rights for each (performance, mechanical, sync, etc.). Plus, there are numerous parties at the table, all of whom need to be paid: artists, managers, labels, publishers, distributors and performance rights organizations, among others.

It is arguably the most global form of media, aside perhaps from video games, often transcending local culture. It’s very challenging for an independent artist to monitor her performance in every market.

It’s omnichannel. Successful musicians monetize in many ways: physical and digital sales; streaming; licensing to emerging platforms, like short-form video (TikTok), video games (Roblox) and connected fitness (Peloton); licensing to TV, films and advertising; touring; merchandise; and sponsorships. Someone has to handle the legal, tracking/measurement and accounting for all that. Generally, musicians get into the music business to make music, not run a global marketing, distribution and logistics business.

Technology Has Reduced, But Not Eliminated a Label’s Value Add

Technology has enabled independent artists to forgo label financing, distribution and marketing, if they choose. But that hardly means labels add no value in each of these functions. Sure, you can record an album in your basement, but today the biggest production costs, particularly for pop music, are teams of songwriters and successful producers. So, for many artists, label advances (which finance production) are still critical. Labels also have relationships to broker collaborations with producers and other artists that would otherwise be inaccessible. They are also marketing powerhouses and can amplify an artist’s work and brand not only on social, but on traditional paid media, terrestrial and satellite radio and streamers’ playlists.

Bargaining Power

Another critical advantage of a major label deal is the labels’ bargaining power over the DSPs. Streaming economics are controversial, but they are still the single largest source of industry revenue. Many observers complain that streaming doesn’t pay artists enough, with Spotify reportedly paying about 1/2 cent per stream on the low end and Apple paying about one cent on the high end — but as shown above in Figure 2, streaming generated $18 billion in revenue globally last year, of which probably $12–13 billion was paid out as license fees and royalties. Whether one thinks per-stream royalties are high enough or not (and since Spotify pays out about 70% of each revenue dollar, it’s easier to argue that the subscription price is too low, not the payout), it’s a lot of money.

In addition, the labels are able to negotiate other favorable terms, such as priority placement in playlists and advantageous pricing on ads. As a result, most artists would prefer to be in a labels’ stable than on their own. Even the most successful artist, say Taylor Swift, Drake or Bad Bunny, will probably represent no more than 2–3% of Spotify streams in a great year — but UMG represents ~30% of streams every year. And it’s not just scale. The labels have enormous bargaining power over the DSPs due to the combination of three factors:

DSPs have been commoditized (from a content perspective). The streaming services all work hard to distinguish their offerings in terms of product (UI, social elements, curation, personalization, etc.) and features (bitrate, spatial audio). But other than a limited amount of exclusive content — such as Spotify’s foray into exclusive podcasts or Tidal’s handful of exclusives— the content library is largely the same. Unlike in video, where exclusive licensing is the norm, almost all music is licensed non-exclusively.

The DSP market is highly competitive. In part due to the practice of non-exclusive licensing, the labels have successfully pitted the DSPs against each other. As shown in Figure 8, the streaming market is relatively fragmented. Spotify is the largest by far, but Apple, TenCent, Amazon and YouTube are all competitive. In addition, just as is the case in video, Apple, Amazon and YouTube have different profit motives than pure-play streamers. It is tough to discern the profitability of any of their music streaming operations, but to the degree that they view them as benefiting other business lines — for instance, that Amazon Music subs are likely to buy more toothpaste, or Apple Music subs are more likely to upgrade their iPhones faster — they may be willing to run these businesses at very low or negative operating margins.

Figure 8. The Music Streaming Market is Fragmented

Note: Dated as of Q2 2022. Source: Midia.

Catalog is critical. As shown in Figure 9, according to Luminate, last year 72% of music consumption was catalog (which is defined as music that has been on the market for 18 months or longer and has fallen below 100 on the Billboard Top 200 chart). While popular culture focuses on the newest music, most of what people actually listen to is catalog. The implication is that the DSPs simply can’t compete without artists like Bruce Springsteen, The Beatles and Michael Jackson (and Elton John…and Justin Bieber…and Coldplay…and Prince…and Miles Davis…and Rodgers and Hammerstein…and…).

Popular culture focuses on the new, but most of what people listen to is catalog.

Figure 9. An Estimated 72% of U.S. Music Consumption is Catalog

Note: ** Catalog = 18 months or older and have fallen below №100 on the Billboard 200 Chart and don’t have a single that is current on any of Billboard’s radio airplay charts. Source: Luminate.

The combination of these three factors shows why the labels have so much power: the DSPs offer a largely undifferentiated product, the streaming market is highly competitive and they all need to offer a full catalog of music. Regardless of how great the Spotify product is (and I think it is), it simply can’t compete without UMG, SME and WMG.

The Labels Face Real Challenges

I don’t want to give the false impression that it’s all smooth sailing for the labels from here, because they clearly face challenges. For instance:

Rising artist bargaining power. Emerging artists have more bargaining power today because they may walk in the door with a few hits and a big social following. In addition, A&R is no longer about hanging around at a smoky club until a 2AM set, it’s now a data analytics function in which everyone has access to the same data and it’s harder to get an edge. So, there’s fierce competition with other labels to sign hot new acts.

More pressure on reversions. Relatedly, while historically recording contracts granted the label performance rights in perpetuity, artists are increasingly seeking “reversions” of their masters after a period of time (say, three-seven years post release). That means that, over time, labels will either lose share, scale and bargaining power or they will need to pony up to buy catalog rights. (As Sony did recently to buy Bob Dylan’s and Bruce Springsteen’s recording rights.) In addition, there is growing competition for these rights from private equity and PE-backed investors.

The explosion of supply is worrying. The labels’ share of streams (Figure 4) has been relatively resilient, but it is under pressure. As described before, between 2019 and 2022, the number of tracks uploaded to Spotify daily increased from 40,000 to 100,000. If that doubles again over the next few years, that will mean over 70 million tracks are being added annually, which will certainly put more pressure on the majors’ share.

AI. AI raises the risk of an even faster increase in the music supply. AI-created covers, collaborations or even new music trained on existing artists’ style create murky legal issues. (Such as this effort to create 1,000 new “Beatles” songs.) The labels will need to create an appropriate framework for protecting their IP and getting paid.

Questions about retail pricing power. The labels have done a great job of facilitating a competitive market for DSPs. The flip side is whether this is also limiting retail pricing power, which directly affects the labels’ revenue share.

So, yes, the label business is hardly worry-free. But the primary point stands: they have done a remarkable job maintaining their prominent role in the value chain despite enormous change.

Compare and Contrast: Music and Video

So, what’s the read across to the media conglomerates? Before working through that, let’s first set the stage.

Suppose it’s 2029. Both the requisite time and cost to produce high quality video content has fallen by 1–2 orders of magnitude. Instead of costing $3, 5 or 10 million per hour for premium scripted content, it costs $100,000 in non-creative labor and cloud compute. Epic’s MetaHumans are indistinguishable from human actors. RunwayML’s Gen-9 makes it easy to create and manipulate realistic sets in hours or minutes and Nvidia’s text-to-3D asset technology makes it easy to create, and then manipulate, 3D models on the fly. All of that enables “live action” programming to be created entirely in a gaming engine, with no physical sets and no humans. Some top actors (and their estates) license their names, likeness and voices to “star” in TV shows and movies. Hollywood is no longer the gatekeeper for financing; at such low production costs, premium video content is also financed by small independent studios or even self-financed, especially by emerging creators. There are several popular scripted TV series available for free on YouTube. On top of all that, several no-code platforms have emerged with tools and templates that make it easy for aspiring creators to make content with virtually no technical skills. While not considered premium, this content still competes for consumers’ time and attention.

Like the current state for music, in this scenario, it will be much easier for quality content to be created and distributed outside the traditional major studio system. How would the traditional studios be positioned?

Figure 10. Music Labels are Positioned Better than Media Conglomerates

Source: Author analysis.

The Good

The good news is that the studios would still play a critical role in this imagined ecosystem and stand to benefit from technology-driven production cost savings.

The studios control critical IP. As premium content proliferates, consumers will gravitate to the type of established IP the studios own and control, something I discussed in Power Laws in Culture. The MCU, Harry Potter, Game of Thrones, DC, Star Wars, Star Trek, etc. are more valuable than ever. Progressive IP owners will be able to increase the value of their IP — and harness the efforts of independent creators — by enabling and encouraging creators to build on it, something I also wrote about in IP as Platform.

Studios provide validation too. Also similar to the labels, working with a major studio will offer creatives validation, helping them attract talent.

Studio development improves the chances of success. The unsung heroes of the creative process in TV are often the studios’ in-house development teams. Much like book editors, they aren’t household names, but they’re often critical to making a show a success. Some creatives bristle at getting “notes,” but others actively want the feedback.

Studios can benefit from lower production costs. Lastly, the studios stand to benefit from lower production costs, even more so than the labels. That’s because video production costs have a lot further to fall. Video and music production both comprise what we could call creative costs (writers, actors, musicians, directors, cinematographers, music producers, etc.) and technical costs (film crew, technology, location costs, soundstage or studio time, audio engineers, etc.). Generally, the cost curve on the latter is affected by technology but the cost curve on the former is not (unless technology can replace some of these people). Technical costs in premium video production are a lot higher than in music. An hour of premium video can run up millions of dollars for crew, locations, VFX, etc., while the technical cost for cutting an album may only run anywhere from a few hundred to a few thousand dollars per track for studio time and audio and mastering engineers. So, while lower technical costs to produce premium video will lower barriers to entry, for those majors that embrace these technologies they also present an opportunity to substantially lower costs.

The Not-as-Good

The bad news is that the major studios are probably at greater risk of disintermediation.

Video monetization is not complex. In comparison to music, the premium video business is extraordinarily simple, especially in recent years. Today, premium scripted and unscripted video has one revenue stream: SVOD. Streamers license all rights, in all windows and all territories, in perpetuity (or for very long periods of time). So, while one of the key benefits of a major label deal is a team to help manage all the complexity of multiple rights, revenue streams and jurisdictions, in video it’s a lot easier for an independent creator or studio to operate without a major. Perhaps this will change in time as new monetization models for video evolve and become more complex. But as long as all the revenue for a TV series comes from licensing it once, it will be easy for independent studios and creators to disintermediate the biggest studios from the process.

In video, new and fresh is much more important than library.

Catalog is much less important in video. As described above, one of the key reasons the labels are so well situated is because of the importance of catalog. Unlike in music, however, in filmed entertainment, catalog is a lot less important. People don’t watch the same movies and TV shows hundreds of times, like they do with music (which is why there is no such thing as a playlist on Netflix). I don’t have a comparable stat regarding what percentage of consumption on Netflix is catalog, but as shown in a recent SVB MoffettNathanson report, viewership of Netflix originals falls off very rapidly after debut (Figure 11). In TV and movies, new and fresh is much more important. While studios control massive libraries of TV shows and movies, this is not as critical a resource in the value chain as is music catalog.

Figure 11. Viewership Falls Off Quickly for Netflix Originals

Source: SVB MoffettNathanson.

Similarly, streaming video distribution has not been commoditized. The streaming music value chain is pretty elegant: labels produce, market and license music; and streamers distribute it to consumers. Relative to this, the streaming video value chain is a bit of a mess. All of the media conglomerates and Netflix are vertically integrated producers-distributors, both producing content and running their own streaming services. Some of them also selectively license content to third parties. Apple, Amazon and Roku produce their own content and distribute third-party apps and streaming services. YouTube is the closest thing to a pure-play distributor. This market structure clearly needs to be rationalized, something I wrote about in What Will Streaming Peace Look Like?. The market can’t support six or seven independent, vertically-integrated streaming services. That may happen either through consolidation or through a migration to more horizontal organization as more streamers license their content (or even entire streaming services) to third-party distributors. Until the dust settles, however, the relative bargaining power of content and distribution in video is unclear — and consequently it is unclear how much bargaining power the major studios will maintain in the value chain.

Talent may limit the studios’ ability to adopt cost-saving technologies. While technology has the potential to reduce video production costs more than music production costs have fallen, studios may struggle to employ them owing to resistance from creatives, trades and agencies— something I recently discussed in You Can’t Just Make the Hits. For instance, there is growing evidence that shooting on a virtual production soundstage (known as a “volume”) can reduce costs by as much as 50%, but studios can’t force directors or showrunners to use them. In addition, last week the WGA (Writer’s Guild of America) and Alliance of Motion Picture and Television Producers (AMPTP) announced that they failed to reach an agreement in their contract negotiations and the WGA called for a writers’ strike. One of the key sticking points is the WGA’s demands about the way AI can and can’t be used in the scriptwriting process. These kinds of issues will probably be resolved in time, but owing to all the diverse, interconnected, vested interests in Hollywood, just because a new technology enables something doesn’t mean it will be easy or quick to deploy.

Media Conglomerates Have to Be Clear-Eyed About the Risks

In recent essays, I’ve been exploring this idea of “infinite TV” from different angles. (You could say harping on it.) That’s because I’ve become even more convinced that the disruption of premium video content creation over the next decade could be even more impactful than the disruption of video distribution over the last one.

The good news for the media conglomerates is that it’s still early and there are strategic steps they can take. The major music labels’ ability to thrive in an infinite content world is a hopeful note. But the media conglomerates aren’t as well positioned. They will need to be both clear-eyed about the risks and proactive to retain their prominence in the value chain.