[Note that this essay was originally published on Medium]

The value of any business, or any financial instrument for that matter, is a function of two things: growth and risk. It has a direct relationship with the former and an indirect relationship with the latter.

It’s widely understood that in the past year growth expectations have declined in the TV business. What isn’t as well understood is that risk is also rising. In this essay, I explain why TV has become riskier, why that’s putting increasing pressure on returns in TV and what the big media companies can do about it.

Tl;dr:

TV and film production has always been a hit-driven business. But the model is riskier than ever for three compounding reasons: spending per project has gone up (duh); risk has shifted to content buyers from sellers; and the variance of returns is climbing because more value is being concentrated in fewer hits.

The first driver of increased risk needs little elaboration. Intuitively and empirically, production cost per TV series and film has climbed in recent years.

Second, risk has shifted to content buyers (streamers and networks) from sellers (talent and studios) because of business practices pioneered by Netflix and adopted industry-wide. These include cost-plus deal structures, massive upfront overall deals for top talent and straight-to-series orders.

Lastly, more value is concentrating in fewer hits for a variety of reasons: the dwindling middle and lengthening tail of popularity means that the biggest hits are relatively bigger than the average; hits are more global than ever; every hit is a potential franchise; and, perhaps most important in a D2C environment, hits have an outsized effect on subscriber acquisition (which I show with new data from Parrot Analytics).

The big media companies need to lower risk. The response so far — shifting resources to franchises — won’t solve the problem owing to franchise commoditization (not “fatigue”) and the rising bargaining power of top talent.

The short term solution is to revert back to historical deal structures that appropriately share risk and reward with talent and independent studios. The long term, and much tougher, solution is a fundamental rethinking of the risk profile of video content creation.

Growth Expectations in TV Have Fallen

I won’t belabor this point. It has become increasingly clear over the past year that streaming won’t likely compensate for declining profits in traditional pay TV. Consumers apparently don’t have an appetite for as many monthly SVOD subscriptions as once hoped; churn is much higher than many expected (with a significant proportion of subscribers regularly disconnecting and reconnecting depending on the content available); and content spend remains very high owing to both the competitive dynamic and the need to satisfy newly empowered consumers’ insatiable demand for new content. To cap it off, the pressure on the traditional pay TV business also continues unabated, with the pace of subscriber losses picking up in recent quarters.

I’ve written about these dynamics in several prior posts, including One Clear Casualty of the Streaming Wars: Profit (10/2020), Is Streaming a Good Business? (08/2022) and Media’s Shift from Growth to Optimization (10/2022).

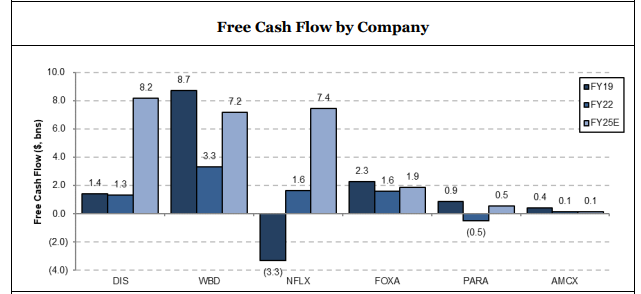

Perhaps the best way to make the point is a recent chart from SVB MoffettNathanson showing free cash flow (FCF) for the major public media companies (Figure 1). Note both the stark decline from peak levels (Disney achieved peak FCF of $9.9 billion in F2018, not shown on the chart) and the expectation that, other than Netflix, none will re-achieve historical levels of FCF by 2025.

Figure 1. Historical and Expected FCF for Media Conglomerates

Note: Disney FCF was ~$9.9 billion in F2018. Disney on September fiscal year, Fox on June fiscal year. Source: SVB MoffettNathanson.

The idea that free cash flow growth expectations have fallen is widely understood. What’s less well understood is that risk has also increased.

Risk Driver #1: Higher Cost per Project

I won’t belabor this point either. (Don’t worry, there’s plenty of belaboring below.) It tracks intuitively that spending per project in TV (and, for that matter, movies) has climbed in recent years. The data also back that up.

Here’s a chart I showed in another recent post, Forget Peak TV, Here Comes Infinite TV (01/23).

Ten years ago, production costs for the average hour-long cable drama were about $3–4 million. Today it is common to see dramas exceed $15 million per episode (Figure 2).

Figure 2. Many TV Series Now Exceed $15 million Per Episode in Production Costs

Source: Stacker.com

The story is similar in film, particularly among the higher-end productions. Here’s some great data from Stephen Follows. As shown in Figure 3, while the median film budget hasn’t changed that much over the past 20 years (and these figures aren’t adjusted for inflation), the median cost of the highest-budget films has almost doubled.

Figure 3. The Median Budget of the Most Expensive Movies Has Almost Doubled in the Last 20 Years

Source: Stephen Follows.

Risk Driver #2: Risk Has Shifted to Buyers

There has been a structural shift of risk from talent and studios to networks and streamers over the past decade too. This is due to several changes in industry practices pioneered by Netflix that have been adopted industry-wide in recent years.

Historically, when producing TV, studios (and, indirectly, talent) would bear relatively high degrees of risk and retain substantial upside. (Note that sometimes studios are independent third parties and sometimes they are owned within the same corporate entity as the network/streaming service. For our purposes, I am making the simplifying assumption that affiliated studios operate at arms length from their affiliated networks/streaming services and will gloss over the distinction and just use the word “studios.”) Studios would license their shows to broadcast (and to a lesser degree, cable) networks at a deficit, meaning that the license fees wouldn’t cover production costs. But studios retained backend rights, so they profited from any home entertainment, international licensing or syndication revenue after the initial run. (And, depending on the contractual relationship between the studios and the show runners/writers/actors, that upside was shared with talent.) That’s how series like Seinfeld, Friends, The Simpsons or The Big Bang Theory became billion-dollar properties for studios and talent.

When Netflix started offering original programming in 2011, it decided to eliminate the backend. It wanted to build its originals library to reduce reliance on licensed content and didn’t want to license those originals to third parties. It also had global ambitions. As a result, it sought to retain rights to its originals for very long periods (generally ten years or more after the series ends), in all territories. To secure those rights, Netflix need a new template to compensate studios and talent. It established several practices, all of which shift risk to networks and streamers:

Cost-plus structures. The most fundamental shift in deal structures was toward “cost-plus deals.” Rather than license shows at a deficit, streamers agreed to pay a premium over cost (“cost-plus”) of generally around 20%. Under this structure, the streamers are paying a premium for all shows, whether they succeed or not. The flip side is that the streamer also owns the rights when a show hits, not the studio. In practice, however, this hasn’t been a great tradeoff. Because they are generally not licensing these shows off platform, there are no more syndication/home entertainment/international windfalls; they have capped the upside. In addition, generally these deals have clauses that increase talent compensation and budgets (and, therefore, the absolute dollar value of the premium, which is a percentage of the budget) if the series extends past a certain number of seasons. Even if this isn’t contractual, the talent has substantial bargaining leverage when negotiating the outer seasons of a hit. A good example is Stranger Things. The first season reportedly cost $6 million per episode and season four reportedly rose to $30 million per episode. Some of the increase was higher production values and much longer run times, but it also included significantly higher compensation for the stars. According to Puck, for instance, Winona Ryder will make $9.5 million for season five, up from $1 million in season one.

Lucrative overall deals. In an overall deal, a studio secures all of a writer/producer’s output for a set period of time (usually two-three years, but sometimes as long as five). It pays a guaranteed fee, which is then recouped to the extent the writer/producer is successful over that period. The highest profile recent overall deals include Ryan Murphy ($300 million from Netflix), Shonda Rhimes (reportedly worth between $300–400 million from Netflix), Tyler Perry ($150 million annually plus an equity stake in BET+ from Paramount), Greg Berlanti ($400 million from WarnerBros. Discovery) and JJ Abrams ($250 million from WarnerBros. Discovery). While these are all as close as you get to household names among showrunners, in recent years it has also become common for many less well-known writers and producers to get overall deals. These deals are all structured differently and the “headline” parenthetical numbers above all mean something different. In some cases (Ryan Murphy), these headline numbers are guaranteed and relatively fixed, in others (Shonda Rhimes), they are structured with lower guarantees and higher incentive payments and the totals are just rough estimates. As a generality though, they include large guaranteed payments even if projects fail and therefore represent a significant risk for streamers.

Straight-to-series orders. Prior to Netflix’s entrance into original programming, common practice in show development involved ordering a pilot episode for somewhere between ~$3–10 million for a scripted hour of TV (although some pilots have run much more than that). Network executives decided whether to greenlight a season (or, often, first half of a season) based on the quality of the pilot and, sometimes, reaction of focus groups. Far less common was the “straight-to-series” order, when a network committed to an entire season, or even several seasons, sight unseen. (An exception that proved the rule was when Disney committed to a whopping 44 episodes of Steven Spielberg’s Amazing Stories in 1985. But that’s Steven Spielberg.) Netflix changed that in 2011 when it ordered two full seasons to win bidding for House of Cards. Since then, straight-to-season orders have become standard practice. This shift has materially changed the risk associated with ordering a new scripted show: rather than spend $5–10 million on a pilot, now it is necessary to spend $80–100 million or more on a full season.

Rather than spend $5–10 million on a pilot, now it’s necessary to spend $80–100 million or more on a full season.

A Brief(ish) Digression: In TV, Content is King Again

The late Sumner Redstone was fond of saying “content is king.” It’s pithy and memorable but not categorically true. While content is arguably the most important component of the overall entertainment experience, it is only one component. Think of it this way: “Content is king” is true in the same sense that “food is king” in the restaurant business. (Service, cleanliness, ambience, location, ease of parking, etc., can all be important factors.)

Non-content elements of an entertainment experience include the UI, including ease of search and quality of recommendations; fidelity (stream quality and resolution of a TV show, graphic quality in a game, bit rate of a song); breadth of supported form factors; whether or not it is interrupted by ads; and social elements, among other things.

In TV, the relative importance of content has changed over time. We can think about this shift in three eras:

Content is King (1980s-2008)

In the pay TV era, when Redstone first coined the phrase, content was clearly critical, because it was the only real differentiator in the TV viewing experience. Most people (~90% of households) purchased a package of cable networks through their local cable or telco operator or a national satellite provider. Everyone watched TV on a…wait for it…television, accessed all their video content through the same (usually crappy) Comcast/DirecTV/Verizon electronic program guide (EPG) and sat through 16–18 minutes per hour of ads. In that environment, the only differentiator in the experience of consuming TV was the program itself.

Content is (Temporarily) Dethroned (2008–2019)

In the early streaming era, when most consumers supplemented their pay TV subscription with one or more SVOD services, the relative importance of content started to decline owing to the rise of new differentiators in the TV experience. These included ad-free vs. ad-supported; all on-demand vs. a mix of on-demand and broadcast; how many episodes or seasons were available on demand; a choice of new form factors; easy search, navigation and discovery (including personalized recommendations); and other advanced features (like playback markers that enabled users to start a show on one device and pick up on another, parental controls, etc.).

Anytime someone came home, turned on Netflix first and then decided what to watch second, he was essentially signaling that other elements of the TV viewing experience had become more important than the content itself. When I was at Turner, we had all kinds of survey data showing that people were opting to only watch ad-free shows or would check to see whether multiple seasons were stacked before starting a new series — both indications of the declining relative importance of the content itself.

Content Returns From Exile (2019-present)

Now we’re in the third era, when the relative value of content has shifted back. Netflix still has a better UI than most other streamers, but its relative competitive advantage has diminished. All streaming content (on Max, Disney+, Peacock, etc.) is now available on demand, with multiple stacked seasons and, if you’re willing to pay for it, ad-free. Since the overall TV viewing experience is sufficiently similar between different streaming services, the actual programming is once again the key differentiating factor.

Now that other elements of the streaming experience are sufficiently similar, content is again the key determinant of quality.

Risk Driver #3: More Value is Concentrated in Fewer Hits

So, while content in general has become more important and valuable, a growing proportion of that value is concentrated in fewer hits. In the language of finance, the variance of returns is increasing, and therefore risk. There are several reasons.

Fatter Head, Longer Tail

This was the topic of my last essay, Power Laws in Culture. The main point was that, even in a world of near-infinite content, entertainment popularity distributions persistently, and in some cases increasingly, approximate power laws: a few massive hits and a very, very (very) long tail. As I described in that piece, this is an inherent feature of networks.

The hits in the head are becoming relatively bigger compared to the average show or movie.

As I also described (and showed empirically), with significant (or growing) consumption in the head and an ever longer tail, the middle is getting hollowed out. So, even if they are not absolutely bigger (higher absolute viewers, constant dollar box office, etc.) the hits in the head are becoming relatively larger compared to the average show or movie.

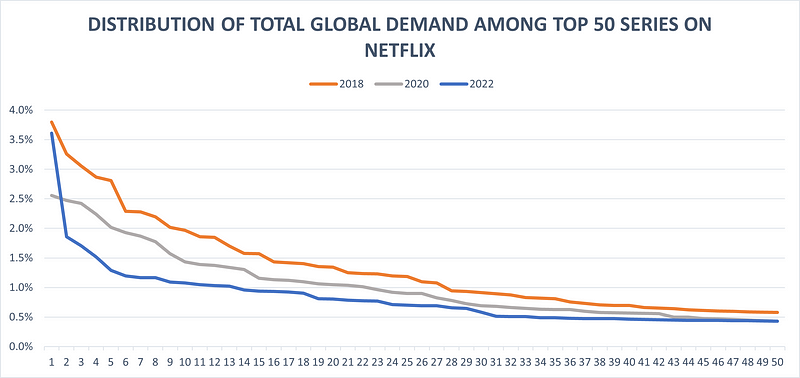

This can be seen in Figure 4, which shows the distribution of global “demand” for top Netflix series in 2018, 2020 and 2022, from Parrot Analytics. Parrot’s demand metric incorporates a variety of inputs (social, fan and critic ratings, piracy, wikis, blogs, etc.) to gauge the popularity of each series and movie on each streaming service. The top chart shows the distribution for the top 250 Netflix series and the bottom zooms in on just the top 50. As shown, over time the distribution of demand is becoming even more skewed to the top hits (note how steeply the blue line drops off from the head of the curve).

Figure 4. For Netflix, the Distribution of Demand for Series is Becoming More Skewed to the Top Hits

Source: Parrot Analytics, Author analysis.

Globalization

It has long been true that domestic (U.S.) hits have been popular internationally, in part because the size of the U.S. entertainment market justified higher investment and consequently better production values than anywhere else. In recent years, however, the reverse has also been true: there has been growing domestic demand for international hits. The result is that the biggest hits, both domestically and foreign-produced, increasingly have broad global appeal.

Figure 5 shows demand data from Parrot for Netflix originals in 2022, both in the U.S. and globally. As shown, of the top 40 most-demanded series both in the U.S. and around the world, 29 were on both lists. In addition, the most-demanded shows in the U.S. included many that debuted internationally, some of which are non-English language, such as Peaky Blinders, Squid Games, Dark, Narcos, Komi Can’t Communicate, La Casa De Papel and The Last Kingdom.

Figure 5. There was High Degree of Overlap Among the Most-Demanded Netflix Original Series Last Year Domestically and Globally

Source: Parrot Analytics.

Hits are Extensible

As I discuss below, in an bid to attract viewers who are overwhelmed by choice, studios have been allocating more resources toward developing “franchises” that revolve around familiar IP.

Clearly, IP with rich mythology — Game of Thrones, Lord of the Rings, the MCU, Harry Potter, etc. — offers almost limitless opportunities for prequels, sequels, reboots and auxiliary story lines. But in recent years, the definition of franchise has broadened; anything that’s considered a hit is now a potential franchise. As recent examples, Yellowstone has spawned three spinoffs, 1883, 1923 and 6666; and Amazon and Michael B. Jordan are reportedly exploring a “Creed-verse” that would include multiple film and TV projects.

Every hit is a latent franchise.

Plus, successful franchises can also be extended into other experiences and products, like gaming, theatrical, live events and merchandise. Netflix recently announced an animated spinoff of Stranger Things and a Stranger Things play and VR game are both expected later this year.

Hits Disproportionately Drive Subs

Hits have always been important. In traditional ad-supported pay TV, for instance, a hit show draws more viewers— which directly increases advertising revenue — and creates a brand halo that draws viewers to other programming on a network and helps attract talent.

But hits are even more important in a direct-to-consumer environment because they have a disproportionate impact on attracting subscribers. Over the last 12–18 months, it has become evident that one of the TV industry’s biggest surprises and biggest problems is high streaming churn. (See To Everything, Churn, Churn, Churn.) Attracting and retaining subscribers are streamers’ top priorities and biggest challenges.

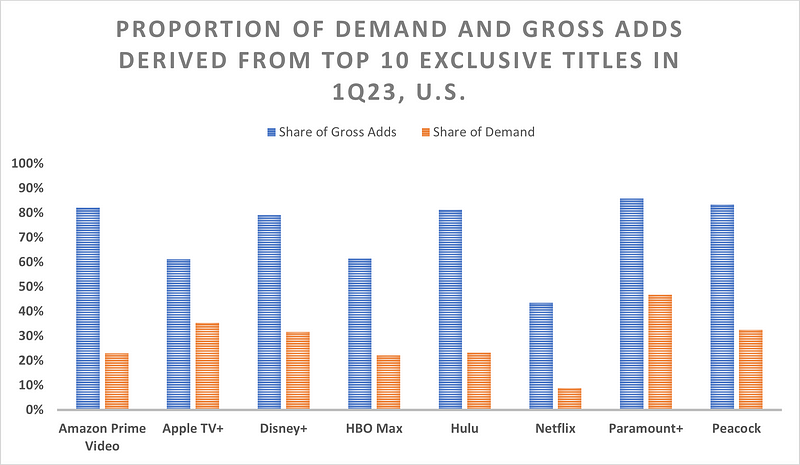

It’s pretty intuitive that the biggest hits are the biggest drivers of subscriber additions. For empirical evidence, let’s look at more Parrot data. In addition to tracking demand for each title, Parrot also tracks the programming that viewers watch both before and after they view each title. As a result, Parrot can estimate to what degree each series or movie attracts new subscribers (i.e., the preceding title viewed is on a different streaming service) or helps retain subscribers (i.e., the preceding title viewed is on the same streaming service).

Figure 6 shows the proportion of both demand and gross adds represented by the top 10 titles on Apple TV+, Amazon Prime Video, Disney+, HBO Max, Hulu, Paramount+, Peacock and Netflix in 1Q23. As shown, these titles represented a large portion of demand (10–50%) and a much larger proportion of gross additions (50–80%).

Figure 6. The Vast Majority of Gross Adds are Tied to the Top 10 Titles

Source: Parrot Analytics.

The TV Business Needs to Reduce Risk

As mentioned at the beginning, the value of any business or financial instrument is a function of growth and risk (of cash flows). There is a direct relationship for the former and an indirect relationship for the latter. When risk goes up, value goes down. For liquid public securities, like stocks or public debt, prices immediately fall when perceived risk rises. Anyone who has ever done a discounted cash flow analysis knows that the net present value of a company is highly sensitive to the debt and equity risk premia embedded in the weighted average cost of capital. In other words, risk matters. A lot.

Mitigating risk is just as important as reinvigorating growth.

The big media companies have recently taken several steps to boost growth, like price increases (from Netflix and Disney), new ad-supported tiers (also Netflix and Disney), some signs of moderation in the pace of content spend, a crackdown on password sharing (Netflix), combination of subscale services to bolster subscriber growth (the combination of Paramount+ with Showtime and HBO Max with Discovery+). But rising risk is also putting increasing pressure on returns. Mitigating risk is just as urgent as reinvigorating growth.

A Shift to Franchises Won’t Work

Big media’s initial attempts at risk mitigation have included allocating more development spend to franchises, as mentioned before. As documented in this great article, a growing proportion of hit movies and TV shows (as well as other media) are derivative content (prequels, sequels, reboots, etc.). Ampere Analysis also found that 64% of SVOD originals in 1H22 were based on pre-existing IP. But allocating more resources to franchises probably won’t meaningfully change the risk profile for a couple of reasons:

Franchise commoditization. Many observers bemoan the growing prevalence of franchises and the concept of “franchise fatigue” periodically rears its head, especially whenever there is a string of unsuccessful franchise extensions (such as recently occurred at Disney, with disappointing results for Andor, The Mandalorian season three and Ant-Man and the Wasp: Quantumania). Whether franchise fatigue is a valid concern is an open question. For every Ant-Man disappointment there is a hit like John Wick 4 around the corner. The implication is that people want quality entertainment, franchise or not. The bigger issue is not fatigue, however, it is commoditization. The premise behind increased allocation of development towards franchises is that, in a crowded marketplace, familiar IP attracts viewers and moviegoers. The problem is that everyone is pursuing the same strategy. It may not be a race to the bottom, but it is a race to the familiar. When everything is a franchise, franchises no longer stand out.

Franchise fatigue isn’t the issue; franchise commoditization is the issue.

High degree of talent bargaining leverage. The other challenge with franchises is that talent often has substantial bargaining power when negotiating franchise extensions. The lead actors for Batman and James Bond may be (somewhat) fungible, since these franchises have swapped actors many times. Other are non-negotiable, like Tom Cruise in Mission Impossible 7 or Top Gun: Maverick, Daniel Craig in Knives Out, Vin Diesel in Fast X, the cast of Stranger Things or Taylor Sheridan (showrunner of Yellowstone and its spinoffs). These stars (and their agents) are well aware that their involvement is critical or sometimes required for a sequel/prequel/reboot to proceed and can extract huge upfront payments and profit participations as a result.

Given the talent costs, “low-risk” franchises aren’t really low risk.

A Short-Term Approach: Share Risk with Talent

So, if franchises aren’t the solution, what is? The most obvious short run solution is a reversion back to historical deal structures that transfer more risk (and potential reward) to talent and studios. This includes a reduction in overall talent deals (or at least tying them more closely to success) and straight-to-series orders. There are signs this is happening. In fact, Netflix recently reportedly ordered its first pilot ever.

The biggest change would be a shift away from cost-plus deals to better align producers’ and distributors’ interests. Netflix has taken an initial step in this direction and is reportedly trying to move premiums to flat rate fees, rather than percentage premiums. A full step would entail lower premiums, and possibly even deficits, in exchange for re-instituting backend participation.

The challenge here, of course, is that it’s difficult to provide backend incentives when most streamers have been reluctant to license to third parties and there still is no backend. One option is to create a “synthetic” backend formula (based on viewership and perhaps other metrics) to calculate and share backend value with talent. Given the pressure on the business and the growing evidence that the full value of content is not being realized when constrained to only one window (i.e., SVOD), it is also increasingly likely that streamers ultimately re-embrace licensing (see Media’s Shift from Growth to Optimization).

Netflix hasn’t done this yet, but there is growing willingness from the traditional media companies. WarnerBros. Discovery has been vocal about its openness to licensing and recently struck a deal to license content to Roku and Tubi. At a recent investor conference Disney CEO Bob Iger also said that the company was re-evaluating making content for third parties. As a possible early indication of this, last month Netflix announced that Arrested Development, which is owned by Disney and was originally slated to leave the service, will stay on after all.

A Long-Term Approach: Fundamentally Rethink “Portfolio Construction” in TV

The industry could conceivably reverse some of the disadvantageous deal structures that it has adopted in recent years (risk driver #2). But what can it do about structurally higher variance of returns (risk driver #3)?

Throughout this essay, I’ve touched on a few financial topics, like risk and variance. Let’s turn to another one: diversification. When professional investors construct a portfolio, they don’t just care about the expected returns, they care about the expected returns per unit of risk, or risk adjusted returns. (The intuition here is that you’d much rather invest in a portfolio with 20% expected upside and 10% potential downside than 20% expected upside and 50% potential downside.) Modern Portfolio Theory (MPT) (which is not so modern, since it was formulated in 1952) dictates that the way to reduce the risk of a portfolio is by adding low correlation investments.

Under MPT, the higher the average variance of the investments in a portfolio, the more low correlation investments you need to produce a given level of risk. This is why, for instance, a private equity fund (which tends to buy relatively stable, cash flowing businesses) might construct a portfolio with 10–15 investments, while a venture capital fund (which invests in much higher risk, earlier stage companies, about half of which usually fail) invests in 20–40 companies, or more.

The TV business needs to think more VC, less PE.

To bring it back to TV, to lower risk, the TV industry needs to think more VC, less PE: it needs a more diversified approach. The implication is that the studio of the future should look much different than the studio of today. Here’s a rough sketch of what that might mean:

More shots on goal at much lower cost, facilitated by new technologies. In light of the increasingly skewed return distributions of content, studios need to take many more shots on goal, at much lower cost. Fortunately, as I discussed a few months ago (Forget Peak TV, Here Comes Infinite TV), this will become increasingly feasible over the next several years as AI-enhanced and assisted production tools evolve and proliferate. Within the relatively near term, it should be possible for smaller creative teams to make very high quality content with significantly smaller budgets and shorter time frames. History dictates that the performance curve will improve very quickly from there. Over the longer term (5+ years), will it be possible to make high quality content for an order of magnitude less, or even more? When you consider that the technological gating factors are the sophistication of algorithms, size of datasets and compute power, the answer is probably yes. For some vivid examples of what these technologies can already do, check out this running Twitter thread:

Social as a development tool, not a marketing tool. Today, studios view social networking as a marketing tool to be leveraged once a show is deep in development or in the can. In the future, however, it will make sense to seed pilots onto “the network” (YouTube, TikTok, etc.) to see which ideas surface and which don’t — and then develop the successful concepts and discontinue those that fail to attract attention.

Better alignment between talent and streamer. Another way to enable more shots on goal is a much more equitable sharing of risk and reward with talent. As described above, today development is incredibly expensive and risky, necessitating that the streamers (with millions of subscribers and billions of dollars of revenue) shoulder most of the risk and retain most of the reward. If the cost of development plummeted, however, this would no longer be necessary. With much lower development costs, it would probably be advantageous to share rights (and therefore profits) much more equally with creatives to incent them to create the best possible product at the lowest possible cost.

Creatives and technologists on an equal footing. In a studio today, there is a very clear hierarchy. Creatives (or the development executives who nurture the relationships with creatives) get the corner office and technologists lurk in the basement pining away for a little sun. In the modern (or post-modern) studio, creatives and technologists would have more equal status. Staying on top of fast-moving technology will be almost as critical as producing the most compelling content.

Easy to Say, Hard to Do

As with many of the things I’ve written recently, the main point is that the TV and film businesses have reached an inflection point and many of the old rules will (eventually) need to at least re-evaluated, if not torn up and re-written.

That’s easy for me to say, of course, but it will be extraordinarily hard to do. The major media companies are part of a large and complex creative ecosystem of talent (both the highly successful and those struggling to make a living), guilds, trades and agencies. (As just one topical example, it is worth noting that in its pending contract renegotiation, the Writers’ Guild of America (WGA) is reportedly seeking to constrain studios’ ability to use AI.)

There are many disparate and often conflicting vested interests in Hollywood, sometimes with cinematically-large egos, and getting them all to march in time will be an enormous challenge. But progressive executives will have to try.